Question: The tax owed is _ dollars? E I Use the 2016 marginal tax rates to compute the tax owed by the following person. | t

The tax owed is _ dollars?

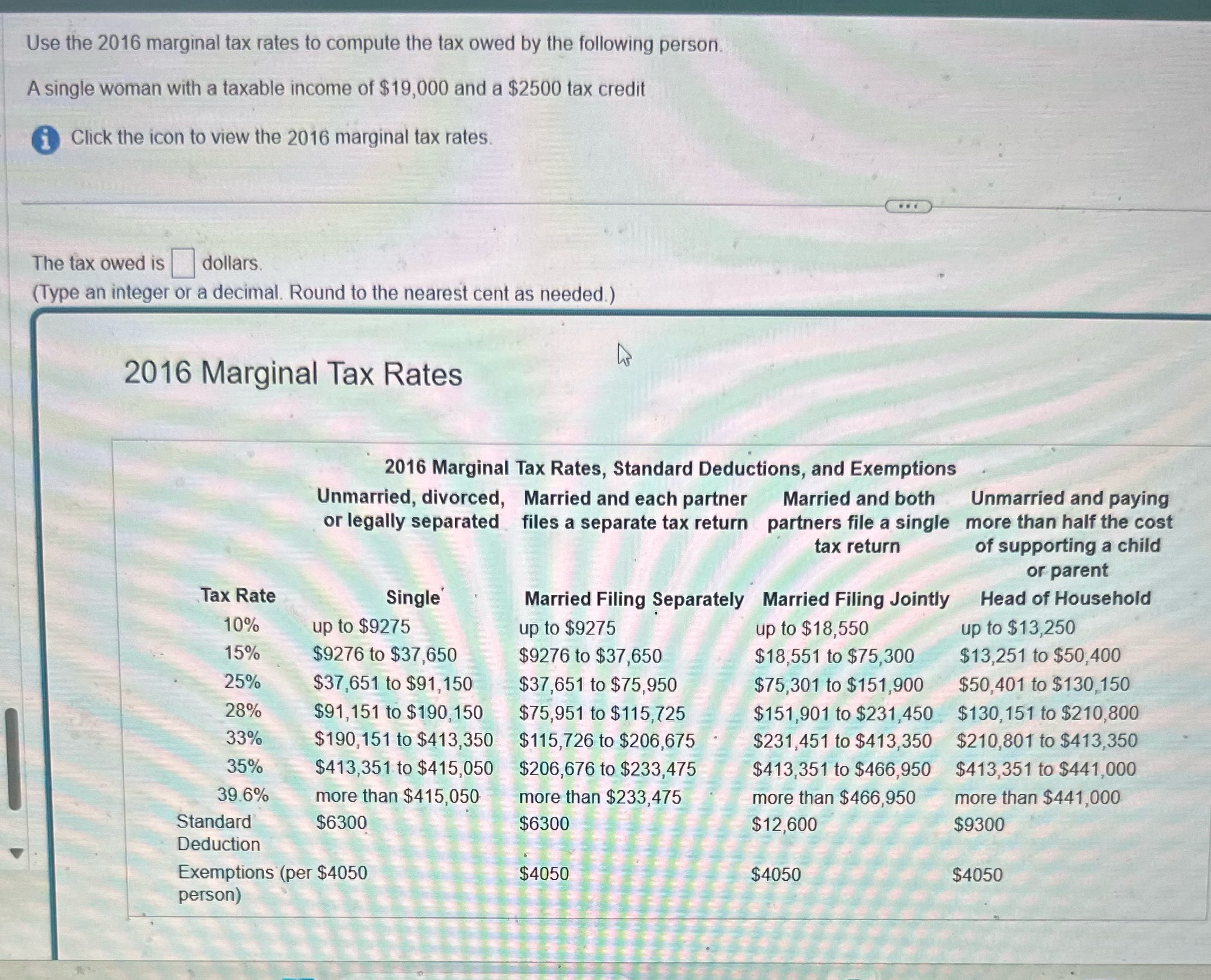

E I Use the 2016 marginal tax rates to compute the tax owed by the following person. | t A single woman with a taxable income of $19,000 and a $2500 tax credit 11 o Click the icon to view the 2016 marginal tax rates. 1 The tax owed is D dollars. (Type an integer or a decimal. Round to the nearest cent as needed) 2016 Marginal Tax Rates | 2016 Marginal Tax Rates, Standard Deductions, and Exemptions ' Unmarried, divorced, Married and each partner Married and both Unmarried and paying or legally separated files a separate tax return partners file a single more than half the cost \\\\ | "~ taxreturn of supporting a child : : or parent \" Tax Rate Single' Married Filing Separately Married Filing Jointly = Head of Household | 10% up to $9275 up to $9275 ' up to $18,550 up to $13,250 1 15% ; $9276 to $37,650 $9276 to $37,650 $18,551 to $75,300 $13,251 to $50,400 i 25% $37,651 to $91,150 $37,651 to $75,950 $75,301 to $151,900 $50,401 to $130,150 | 28% $91,151 to $190,150 $75,951 to $115,725 $151,901 to $231,450 $130,151 to $210,800 E 33% $190,151 to $413,350 $115,726 to $206,675 $231,451t0 $413,350 $210,8071 to $413,350 1 35% $413,351 to $415,050 $206,676 to $233,475 $413,351 to $466,950 $413,351 to $441,000 | 39 6% more than $41 5,05}) more than $233,475 more than $466,950 more than $441,000 \" Standard $6300 $6300 $12,600 $9300 > - Deduction v s Exemptions (per $4050 $4050 $4050 $4050 ' person) ; e ik )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts