Question: : The technical differences between tax law and account are: a. There is no difference in the way income and expendicture is dealt with by

: The technical differences between tax law and account are:

a.

There is no difference in the way income and expendicture is dealt with by tax law and the under the principles of accounting.

b.

Not all receipts are recognised for tax purposes, Income tax law excludes some income and expenses for policy reasons, it ignores some transactions on the basis of ant-avoidance provisions and timing rules differ in income tax law and under accounting principles

c.

Tax law is based on accounting principles only.

d.

Some accounting principles are all contained within tax regulations

Sources of taxation law in Australia are:

a.

Legislation, which is the Income Tax Assessment Act 1997 only.

b.

The Income Tax Assessment Act 1936(Cth) and case law only.

c.

Income tax legislation, regulations, case law and rulings by the tax commissioner.

d.

The Income Tax Assessment Acts of 1936 and 1997 and case law only.

The CBS News study was led by YouGov utilizing a broadly delegate test of 2,075 U.S. occupants met online between April 1-3, 2019. At the point when asked what the 2017 assessment law means for well off individuals, 1,266 said that the expense law helps affluent individuals. At the point when asked what the 2017 expense law means for working class individuals, 643 said that the duty law assists center with classing Americans.

A measurements understudy needs to test for a genuinely critical distinction in the extent of Americans who accept the assessment law helps affluent individuals and the extent of Americans who accept the expense law helps the working class. Is this a proper test for the understudy to use in the present circumstance? Why or why not?

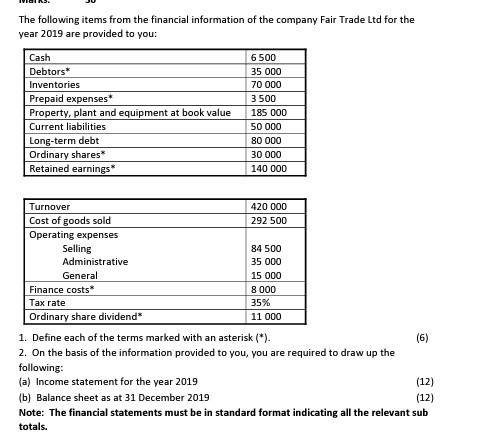

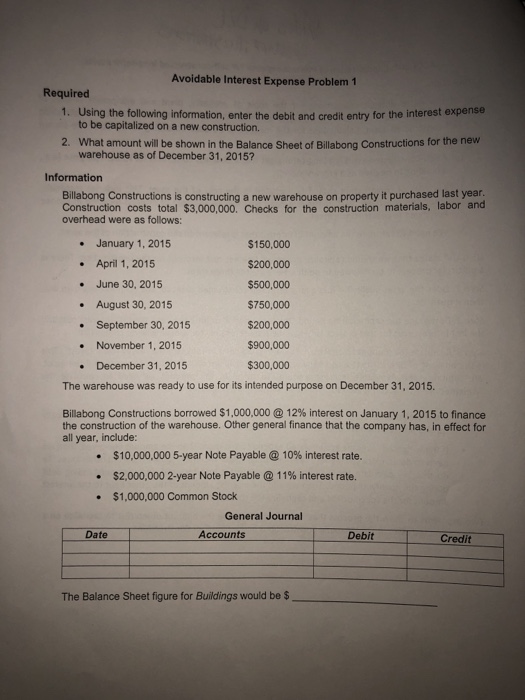

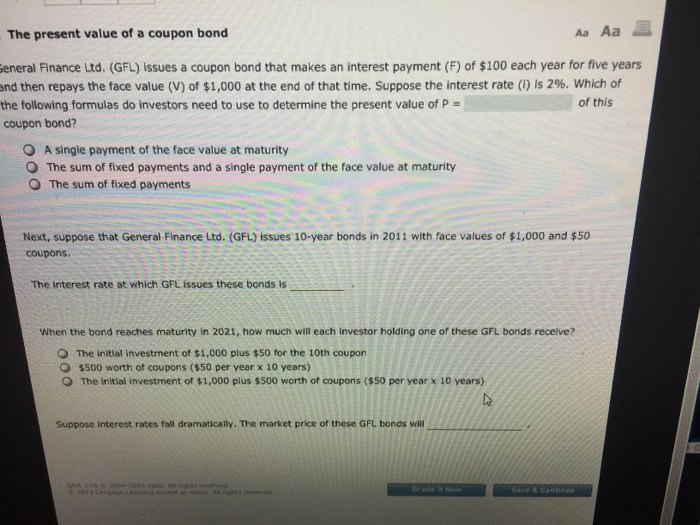

The following items from the financial information of the company Fair Trade Ltd for the year 2019 are provided to you: Cash 6500 Debtors* 35 000 Inventories 70 000 Prepaid expenses" 3 500 Property, plant and equipment at book value 185 000 Current liabilities 50 000 Long-term debt 80 000 Ordinary shares" 30 000 Retained earnings* 140 000 Turnover 420 000 Cost of goods sold 292 500 Operating expenses Selling 84 500 Administrative 35 000 General 15 000 Finance costs* 8 000 Tax rate 35% Ordinary share dividend* 11 000 1. Define each of the terms marked with an asterisk (* ). (6) 2. On the basis of the information provided to you, you are required to draw up the following: (a) Income statement for the year 2019 (12] (b) Balance sheet as at 31 December 2019 (12) Note: The financial statements must be in standard format indicating all the relevant sub totals.Avoidable Interest Expense Problem 1 Required 1. Using the following information, enter the debit and credit entry for the interest expense to be capitalized on a new construction. 2. What amount will be shown in the Balance Sheet of Billabong Constructions for the new warehouse as of December 31, 20157 Information Billabong Constructions is constructing a new warehouse on property it purchased last year. Construction costs total $3,000,000. Checks for the construction materials, labor and overhead were as follows: January 1, 2015 $150,000 . April 1, 2015 $200,000 June 30, 2015 $500,000 . August 30, 2015 $750,000 September 30, 2015 $200,000 November 1, 2015 $900,000 December 31, 2015 $300,000 The warehouse was ready to use for its intended purpose on December 31, 2015. Billabong Constructions borrowed $1,000,000 @ 12% interest on January 1, 2015 to finance the construction of the warehouse. Other general finance that the company has, in effect for all year, include: $10,000,000 5-year Note Payable @ 10% interest rate. $2,000,000 2-year Note Payable @ 11% interest rate. $1,000,000 Common Stock General Journal Date Accounts Debit Credit The Balance Sheet figure for Buildings would be $The present value of a coupon bond Aa Aa eneral Finance Ltd. (GFL) issues a coupon bond that makes an interest payment (F) of $100 each year for five years and then repays the face value (V) of $1,000 at the end of that time. Suppose the interest rate (1) is 2%. Which of the following formulas do investors need to use to determine the present value of P = of this coupon bond? A single payment of the face value at maturity The sum of fixed payments and a single payment of the face value at maturity O The sum of fixed payments Next, suppose that General Finance Lid. (GFL) issues 10-year bonds in 2011 with face values of $1,000 and $50 coupons. The interest rate at which GFL issues these bonds is When the bond reaches maturity In 2021, how much will each Investor holding one of these GFL bonds receive? The initial investment of $1,000 plus $50 for the 10th coupon $500 worth of coupons ($50 per year x 10 years) O The initial investment of $1,000 plus $500 worth of coupons ($50 per year x 10 years) Suppose Interest rates fall dramatically. The market price of these GFL bonds will Grade It Now Save & Continue