Question: The term global target capital structure for an MNC represents the MNC's capital structure. in its country of domicile relative to competitors across all countries

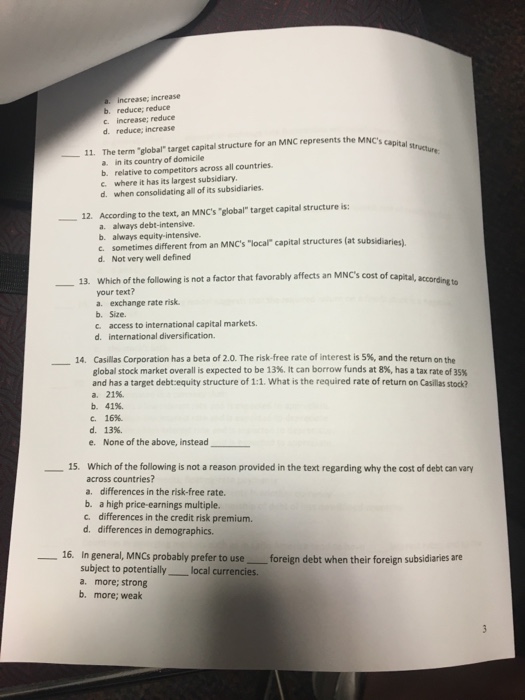

The term "global" target capital structure for an MNC represents the MNC's capital structure. in its country of domicile relative to competitors across all countries where it has its largest subsidiary. when consolidating all of its subsidiaries. According to the text, an MNC's "global" target capital structure it: always debt-intensive. always equity-intensive. sometimes different from an MNC's "local" capital structures (at subsidiaries). Not very well defined Which of the following is not a factor that favorably affects an MNC's cost of capital, according to your text? exchange rate risk. Size. access to international capital markets. international diversification. Casillas Corporation has a beta of 2.0. The risk-free rate of .merest is 5%, and the return on the global stock market overall is expected to be 13%. It can borrow funds at 8%, has a tax rate of 35% and has a target debt:equity structure of 1:1 What is the required rate of return on Casillas stock? 21%. 41%. 16%. 13%. None of the above, instead Which of the following is not a reason provided in the text regarding why the cost of debt can vary across countries? differences in the risk-free rate. a high price-earnings multiple. differences in the credit risk premium. differences in demographics. In general, MNCs probably prefer to use foreign debt when their foreign subsidiary are subject to potentially local currencies. more; strong more; weak

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts