Question: the term practice before the its includes the representation l CIEular 230. In addition, CPAs in tax practice are subject to two other sets l

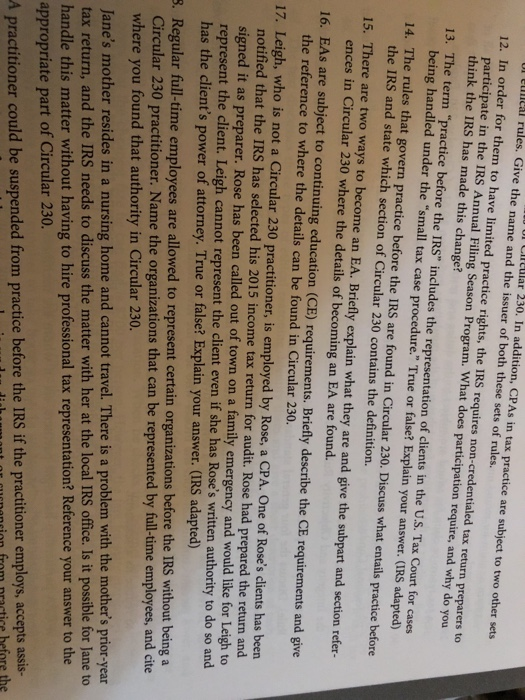

l CIEular 230. In addition, CPAs in tax practice are subject to two other sets l eneal rules. Give the name and the issuer of both these sets of rules. 12. In order for them to have limited practice rights, the IRS requires non-credentialed tax return preparers to participate in the IRS Annual Filing Season Program. What does participation require, and why do you think the IRS has made this change? 13. The term "practice before the IRS" includes the representation of clients in the U.S. Tax Court for cases being handled under the "small tax case procedure." True or false? Explain your an 14. The rules that govern practice before the IRS are found in Circular 230. Discuss what entails practice before swer. (IRS adapted) the IRS and state which section of Circular 230 contains the definition. 15. There are two ways to become an EA. Briefly explain what they are and give the subpart and section refer- ences in Circular 230 where the details of becoming an EA are found. 16. EAs are subject to continuing education (CE) requirements. Briefly describe the CE requirements and give the reference to where the details can be found in Circular 230 17. Leigh, who is not a Circular 230 practitioner, is employed by Rose, a CPA. One of Rose's dients has been notified that the IRS has selected his 2015 income tax return for audit. Rose had prepared the return and signed it as preparer. Rose has been called out of town on a family emergency and would like for Leigh to represent the client. Leigh cannot represent the client even if she has Rose's written authority to has the client's power of attorney. True or false? Explain your answer. (IRS adapted) do so and gular full-time employees are allowed to represent certain organizations before the IRS without being a Circular 230 practitioner. Name the organizations that can be represented by full-time employees, and cite where you found that authority in Circular 230 8. Re Jane's mother resides in a nursing home and cannot travel. There is a problem with the mother's prior-year tax return, and the IRS needs to discuss the matter with her at the local IRS office. Is it possible for Jane to handle this matter without having to hire professional tax representation? Reference your answer to the appropriate part of Circular 230 practitioner could be suspended from practice before the IRS if the practitioner employs, accepts assis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts