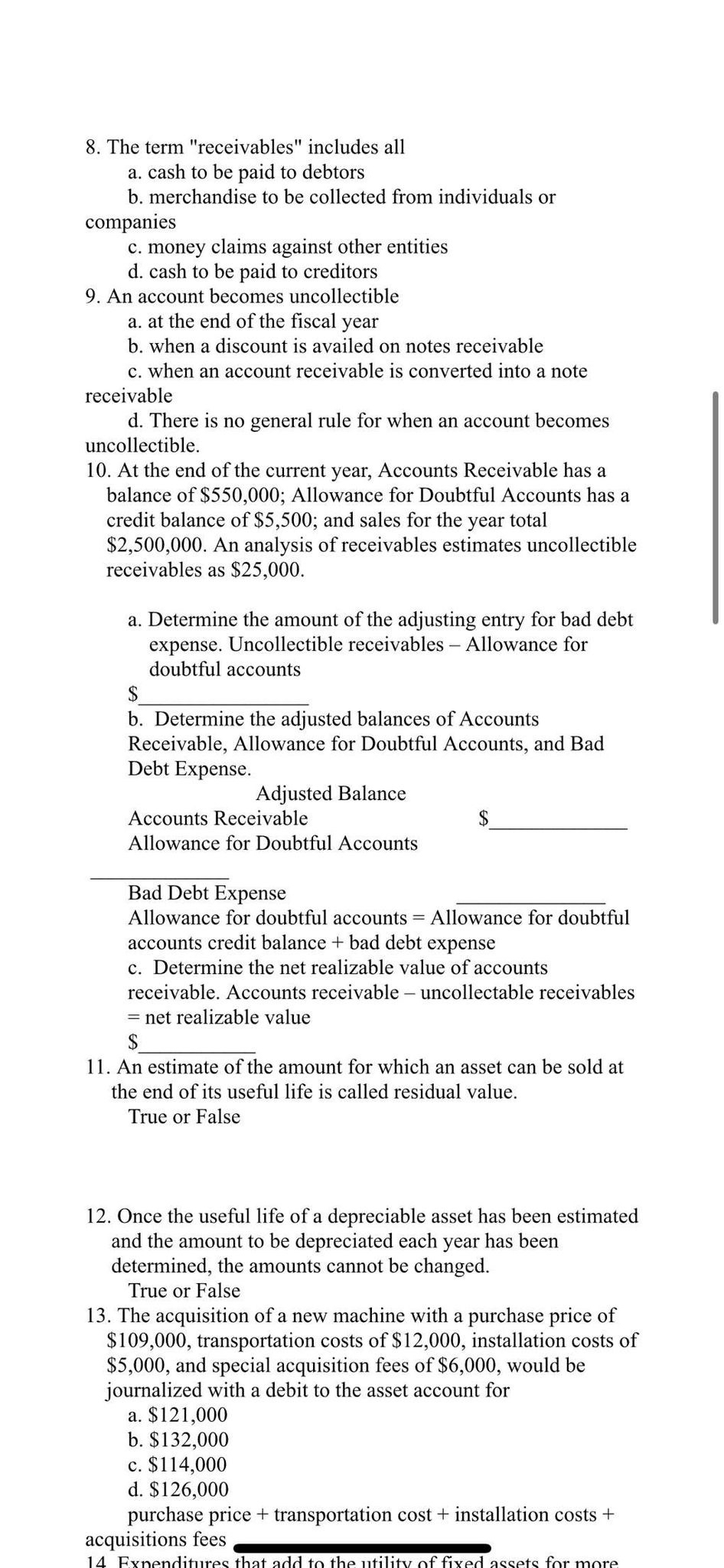

Question: The term receivables includes all a . cash to be paid to debtors b . merchandise to be collected from individuals or companies c .

The term "receivables" includes all

a cash to be paid to debtors

b merchandise to be collected from individuals or companies

c money claims against other entities

d cash to be paid to creditors

An account becomes uncollectible

a at the end of the fiscal year

b when a discount is availed on notes receivable

c when an account receivable is converted into a note receivable

d There is no general rule for when an account becomes uncollectible.

At the end of the current year, Accounts Receivable has a balance of $; Allowance for Doubtful Accounts has a credit balance of $; and sales for the year total $ An analysis of receivables estimates uncollectible receivables as $

a Determine the amount of the adjusting entry for bad debt expense. Uncollectible receivables Allowance for doubtful accounts

$

b Determine the adjusted balances of Accounts

Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense.

Adjusted Balance

Accounts Receivable

Allowance for Doubtful Accounts

Bad Debt Expense

Allowance for doubtful accounts Allowance for doubtful accounts credit balance bad debt expense

c Determine the net realizable value of accounts receivable. Accounts receivable uncollectable receivables net realizable value $

An estimate of the amount for which an asset can be sold at the end of its useful life is called residual value.

True or False

Once the useful life of a depreciable asset has been estimated and the amount to be depreciated each year has been determined, the amounts cannot be changed.

True or False

The acquisition of a new machine with a purchase price of $ transportation costs of $ installation costs of $ and special acquisition fees of $ would be journalized with a debit to the asset account for

a $

b $

c $

d $

purchase price transportation cost installation costs acquisitions fees

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock