Question: The three - period binomial interest rate tree provided below gives one - period interest rates and prices of zero - coupon bonds. Starting at

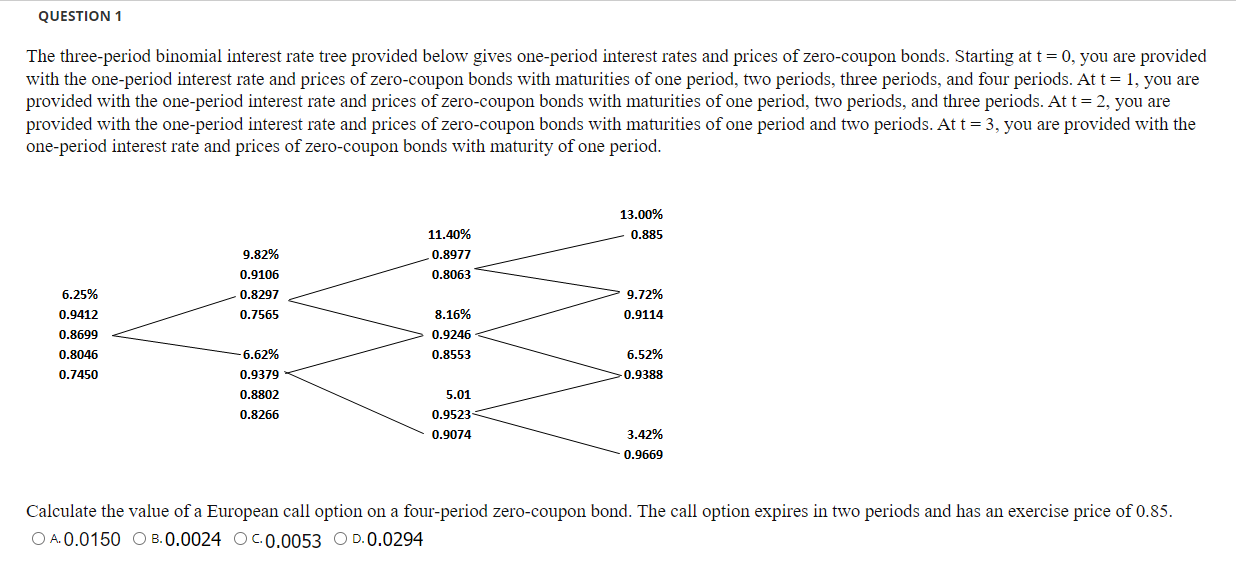

The threeperiod binomial interest rate tree provided below gives oneperiod interest rates and prices of zerocoupon bonds. Starting at t you are provided with the oneperiod interest rate and prices of zerocoupon bonds with maturities of one period, two periods, three periods, and four periods. At t you are provided with the oneperiod interest rate and prices of zerocoupon bonds with maturities of one period, two periods, and three periods. At t you are provided with the oneperiod interest rate and prices of zerocoupon bonds with maturities of one period and two periods. At t you are provided with the oneperiod interest rate and prices of zerocoupon bonds with maturity of one period. Calculate the value of a European call option on a fourperiod zerocoupon bond. The call option expires in two periods and has an exercise price of

A

B

C

D

QUESTION

The threeperiod binomial interest rate tree provided below gives oneperiod interest rates and prices of zerocoupon bonds. Starting at you are provided

with the oneperiod interest rate and prices of zerocoupon bonds with maturities of one period, two periods, three periods, and four periods. At you are

provided with the oneperiod interest rate and prices of zerocoupon bonds with maturities of one period, two periods, and three periods. At you are

provided with the oneperiod interest rate and prices of zerocoupon bonds with maturities of one period and two periods. At you are provided with the

oneperiod interest rate and prices of zerocoupon bonds with maturity of one period.

Calculate the value of a European call option on a fourperiod zerocoupon bond. The call option expires in two periods and has an exercise price of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock