Question: The time expected to pass before the net cash flows from an Investment would return Its Initial cost is called the Multiple Choice ed Discounted

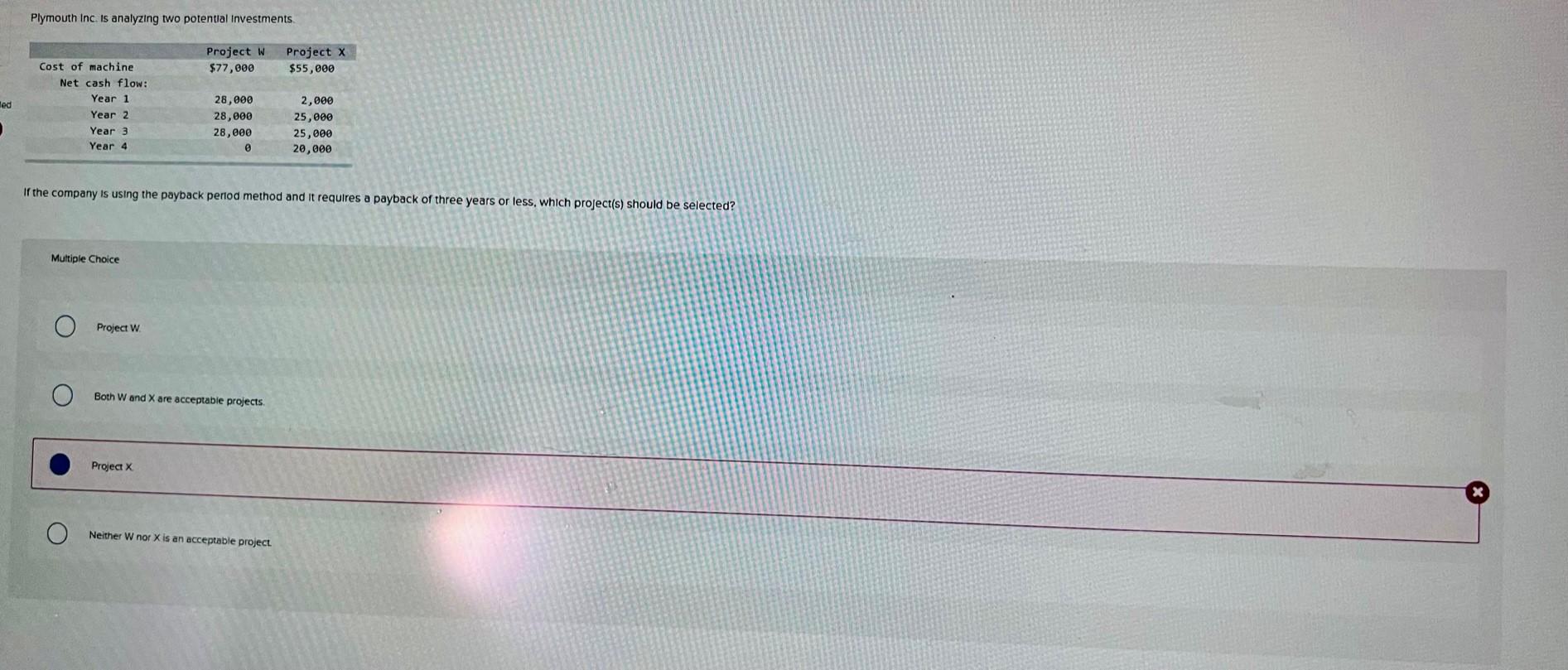

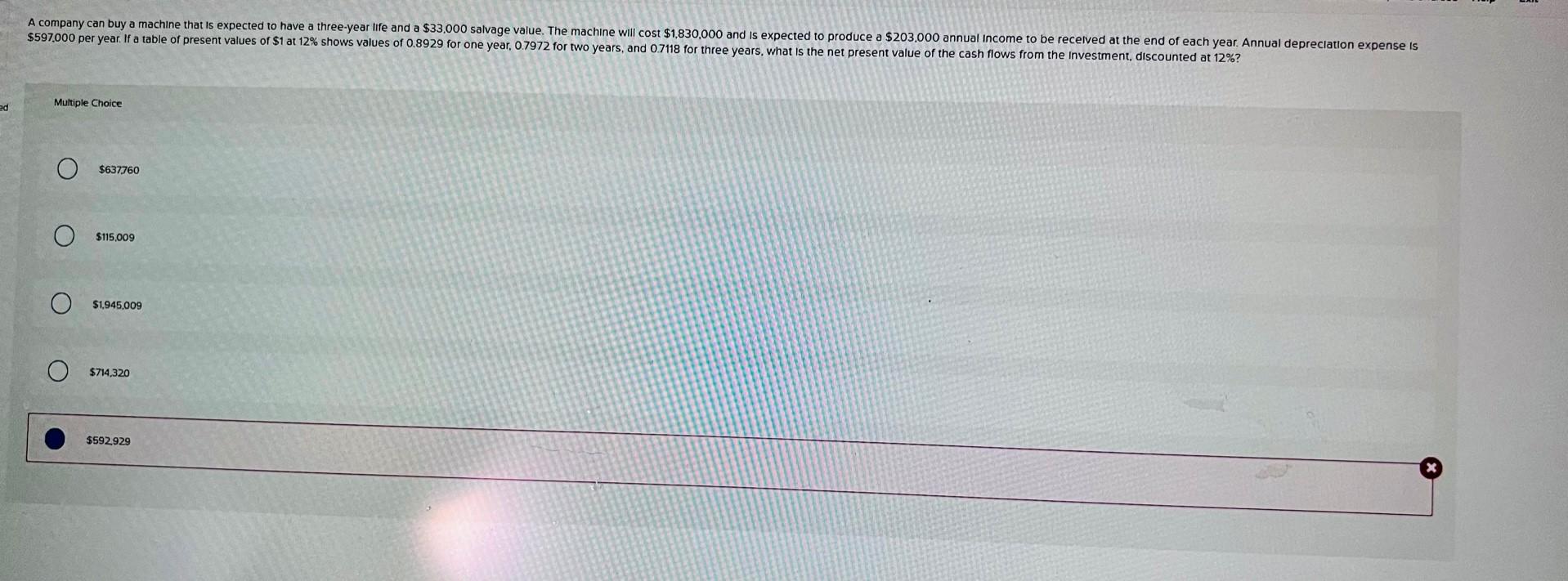

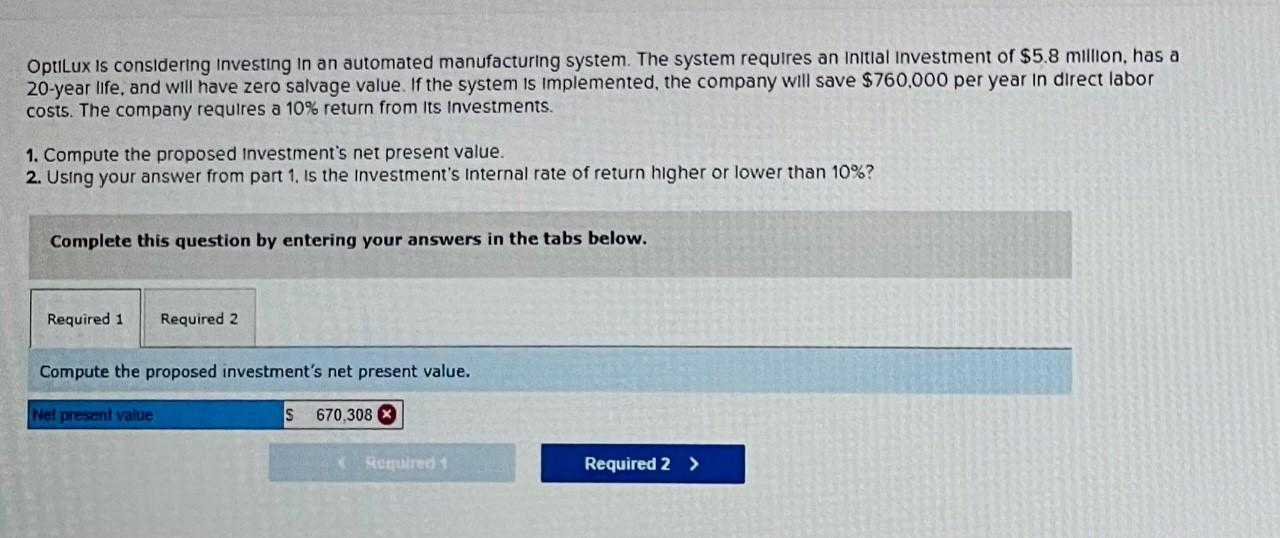

The time expected to pass before the net cash flows from an Investment would return Its Initial cost is called the Multiple Choice ed Discounted cash flow period. Payback period Budgeting period Interest period Amortization period. Plymouth Inc. is analyzing two potential Investments Project W $77,000 Project X $55,000 ted Cost of machine Net cash flow: Year 1 Year 2 Year 3 Year 4 28,000 28,000 28,000 @ 2,000 25,000 25,000 20,000 If the company is using the payback period method and it requires a payback of three years or less, which project(s) should be selected? Multiple Choice Project W Both W and X are acceptable projects Project X Neither W nor X is an acceptable project. The process of restating future cash flows In today's dollars is known as: Multiple Choice Annualization Payback period. Discounting Budgeting Capitalizing A company can buy a machine that is expected to have a three-year life and a $33,000 salvage value. The machine will cost $1,830,000 and is expected to produce a $203,000 annual income to be received at the end of each year. Annual depreciation expense is $597,000 per year. If a table of present values of $1 at 12% shows values of 0.8929 for one year, 0.7972 for two years, and 0.7118 for three years, what is the net present value of the cash flows from the investment, discounted at 12%? Multiple Choice ad $637760 $115,009 $1,945,009 $714,320 O $592929 Optilux is considering Investing in an automated manufacturing system. The system requires an initial Investment of $5.8 million, has a 20-year life, and will have zero salvage value. If the system is Implemented, the company will save $760,000 per year in direct labor costs. The company requires a 10% return from Its Investments. 1. Compute the proposed Investment's net present value. 2. Using your answer from part 1. is the investment's Internal rate of return higher or lower than 10%? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the proposed investment's net present value. Nel present value 670,308 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts