Question: The Tower Inc. (as lessor) leased a building under a 15 year operating lease with annual payments of $15,000 payable in arrears. The cost

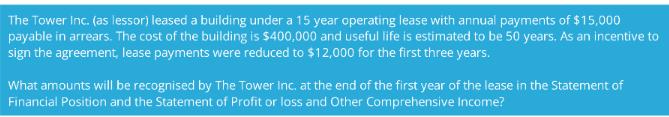

The Tower Inc. (as lessor) leased a building under a 15 year operating lease with annual payments of $15,000 payable in arrears. The cost of the building is $400,000 and useful life is estimated to be 50 years. As an incentive to sign the agreement, lease payments were reduced to $12,000 for the first three years. What amounts will be recognised by The Tower Inc. at the end of the first year of the lease in the Statement of Financial Position and the Statement of Profit or loss and Other Comprehensive Income?

Step by Step Solution

There are 3 Steps involved in it

It appears that youre asking about accounting treatment for a lease agreement under International Financial Reporting Standards IFRS for The Tower Inc ... View full answer

Get step-by-step solutions from verified subject matter experts