The Transco Company is considering making and supplying computer-controlled traffic- signal switching boxes to be used...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

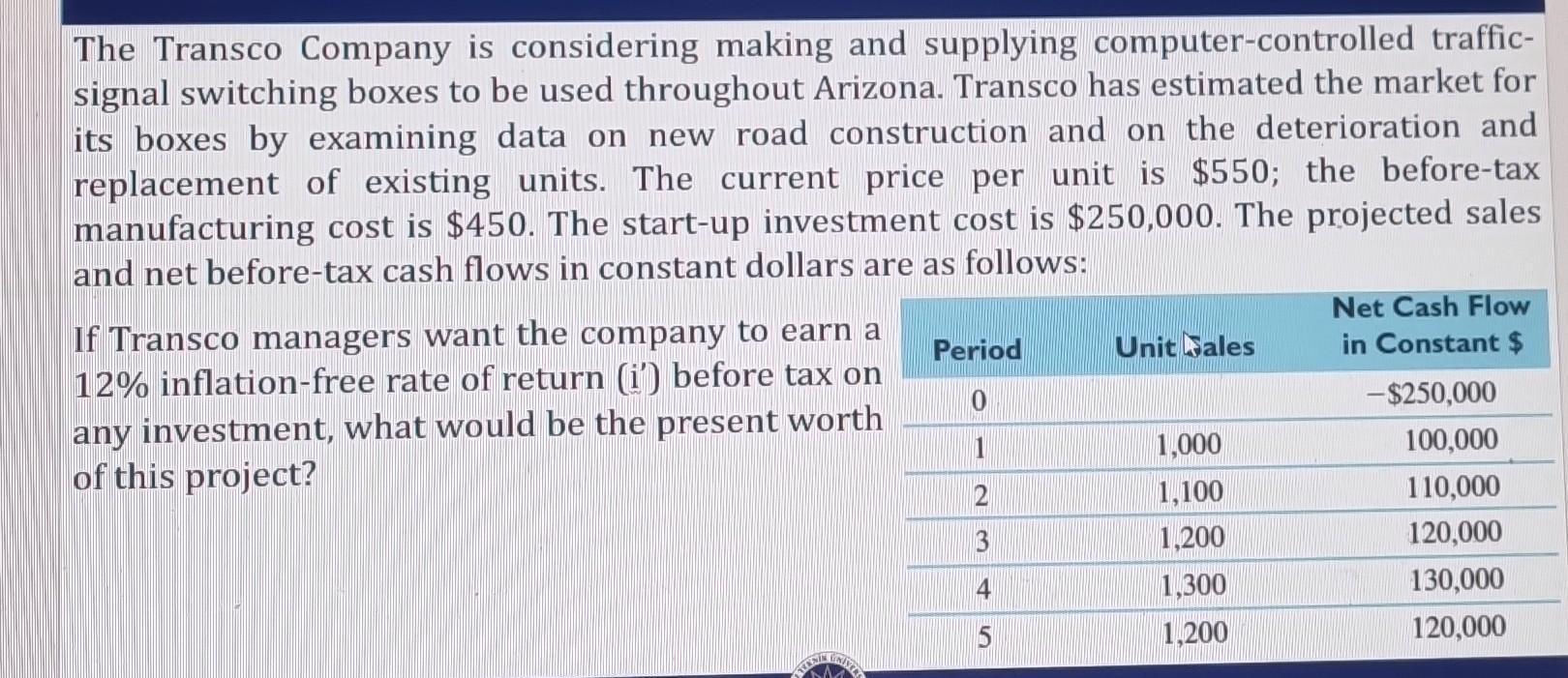

The Transco Company is considering making and supplying computer-controlled traffic- signal switching boxes to be used throughout Arizona. Transco has estimated the market for its boxes by examining data on new road construction and on the deterioration and replacement of existing units. The current price per unit is $550; the before-tax manufacturing cost is $450. The start-up investment cost is $250,000. The projected sales and net before-tax cash flows in constant dollars are as follows: If Transco managers want the company to earn a 12% inflation-free rate of return (i') before tax on any investment, what would be the present worth of this project? KNIN UNIVER Period 10 1 2 3 4 5 Unit ales 1,000 1,100 1,200 1,300 1,200 Net Cash Flow in Constant $ -$250,000 100,000 110,000 120,000 130,000 120,000 The Transco Company is considering making and supplying computer-controlled traffic- signal switching boxes to be used throughout Arizona. Transco has estimated the market for its boxes by examining data on new road construction and on the deterioration and replacement of existing units. The current price per unit is $550; the before-tax manufacturing cost is $450. The start-up investment cost is $250,000. The projected sales and net before-tax cash flows in constant dollars are as follows: If Transco managers want the company to earn a 12% inflation-free rate of return (i') before tax on any investment, what would be the present worth of this project? KNIN UNIVER Period 10 1 2 3 4 5 Unit ales 1,000 1,100 1,200 1,300 1,200 Net Cash Flow in Constant $ -$250,000 100,000 110,000 120,000 130,000 120,000

Expert Answer:

Answer rating: 100% (QA)

Step 12 The present worth of the project can be calculated by discounting the expected fut... View the full answer

Related Book For

Financial Analysis with Microsoft Excel

ISBN: 978-1285432274

7th edition

Authors: Timothy R. Mayes, Todd M. Shank

Posted Date:

Students also viewed these accounting questions

-

The Extron Oil Company is considering making a bid for a shale oil development contract to be awarded by the federal government. The company has decided to bid $110 million. The company estimates...

-

The Americo Oil Company is considering making a bid for a shale oil development contract to be awarded by the federal government. The company has decided to bid $112 million. The company estimates...

-

The American Aluminum Company is considering making a major investment of $150 million ($5 million for land, $45 million for buildings, and $100 million for manufacturing equipment and facilities) to...

-

What is a time series? Explain the four characteristics that time series may exhibit and provide some practical examples.

-

Let v1, v2, . . . .,vn be the edges of a polygon arranged in cyclic order as shown for the cas n = 7 in Figure 19. Show that v1, v2 + .... + vn = 0 V2 15 N6

-

Discuss the roles of primary dealers and the reason for underpricing in U.S. Treasury auctions.

-

E2.8. Finding Financial Statement Information on the Internet (Easy) The Securities and Exchange Commission (SEC) maintains the EDGAR database of com- pany filings with the commission. Explore the...

-

CAF Company sells office equipment and supplies to many organizations in the city and surrounding area on contract terms of 2/10, n/30. In the past, over 75% of the credit customers have taken...

-

All of the following are major rating methods used in property/casualty insurance except a. Class rating b. Judgment rating c. Merit rating d. Prospective rating Bonus +3 : Name three different types...

-

Preparing an Individuals Tax Form. Caleb Lee graduated from college in 2018 and began work as a systems analyst in July of that year. He is preparing to file his income tax return for 2018, and has...

-

Multiple Choice Question 92 Waterway Industries's variable costs are 30% of sales. The company is contemplating an advertising campaign that will cost $65000. If sales are expected to increase...

-

Carla Vista Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2025, the following balances relate to this plan Plan assets $489,900 Projected benefit obligation 616,700...

-

Question 2 of 8 Shirts were purchased for $12.50 each and were marked up by $18.75. During Christmas, they were discounted by $6.85 per shirt. a. What was the rate of markdown? % Round to two decimal...

-

The cost versus quality decision is one that only few companies get right. What is the cost of quality? It is very high for some companies such as Ford and Bridgestone/Firestone, whose reputations...

-

Find the absolute maximum and absolute minimum values of the function f(x) (x-2)(x-5)+7 = on each of the indicated intervals. Enter 'NONE' for any absolute extrema that does not exist. (A) Interval =...

-

4. Roll one 10-sided die 12 times. The probability of getting exactly 4 eights in those 12 rolls is given by (a) 10 9 4 10 10 (b) HA 9 -HAA (c) 1 (d) 9 (c) 10 9 () 10

-

PART C. (15 POINTS) Superior Company has the following cost and expense data for the year ending December 31, 2017. Raw materials, 1/1/17 $ 30,000 Insurance, factory $ 14,000 Raw materials, 12/31/17...

-

CdF2 (s) Cd+ (aq) + 2 F- (aq) 1. A saturated solution of CdF2 is prepared. The equilibrium in the solution is represented above. In the solution [Cd+] eq = 0.0585 M and [F-] eq = 0.117 M. a....

-

Do problem 3 again, but this time do not allow short sales (i.e., no negative weights). a. Create a new chart that shows the efficient frontiers from this problem and problem 3. b. From which...

-

Using the Yahoo! Finance Web site (finance.yahoo.com) get the current price and five year dividend history for Intel. To gather this data, enter the ticker symbol (INTC) in the search box at the top...

-

Suppose that at the end of December 2008 you purchased shares in Apple, Inc. (Nasdaq: AAPL). It is now five years later and you decide to evaluate your holdings to see if you have done well with this...

-

5.Acity government has a nine-year capital lease for property being used within the General Fund. The lease was signed on January 1,2008. Minimum lease payments total $90,000 starting at the end of...

-

19. What are the two fund-based financial statements for governmental funds? What information does each normally present?

-

18. What are the two government-wide financial statements? What does each normally present?

Study smarter with the SolutionInn App