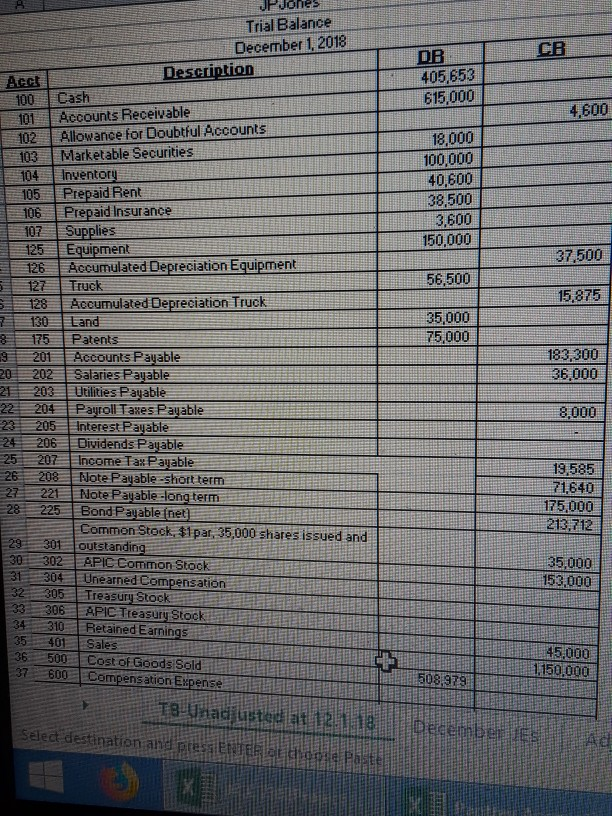

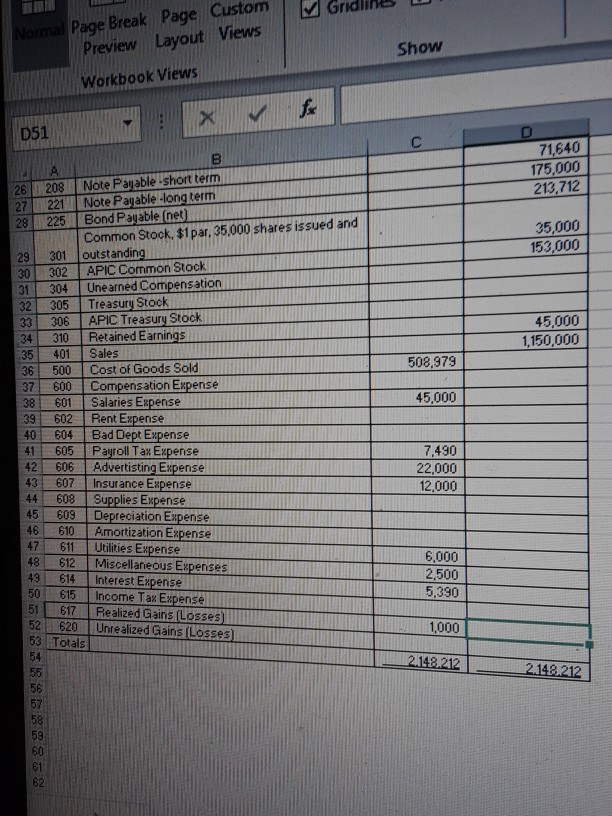

Question: The trial balance sheet is on the second part Record the following adjusting entries in general journal form as of December 31, 2018: Supplies on

The trial balance sheet is on the second part

Record the following adjusting entries in general journal form as of December 31, 2018:

- Supplies on hand at the end of the year: $450

- Equipment shown on the 12/1 TB was purchased on 1/1/17, has a 8 year life, no salvage value and company uses double-declining balance method for its depreciation.

- Included in the truck balance is a fully depreciated truck for $6,500 and a new truck valued at $50,000 which was purchased on 1/1/17. The new truck has a 9-year life, no salvage value and the company uses the sum-of-the-years digits for its depreciation method on this asset.

- The patent was purchased on 1/1/2013 for $100,000 and its useful life is 20 years.

- $18,600 was paid on September 1, 2018 for six months rent

- On 3/1/18, paid $22,500 for a 12-month insurance policy.

- Declared dividends of $15,000 on December 31

- The fair market value of the securities (classified as marketable) is $19,500.

- 4% of Accounts Receivable is estimated to be uncollectible. Company uses the allowance method for estimating its uncollectible accounts.

- Accrued salaries expense of $6,000 and recorded Payroll tax expense on account of $2300.

- Had issued $200,000 of 6%, 10-year bond, dated 1/1/17 for $215,589 when the market rate was 5%. Interest is paid on June 30 and January 1 using the effective interest rate method. The June payment is included in the Dec. 1 TB. (Additional credit awarded if amortization table is included)

- One month has passed since the issuance of restricted stock.

- Interest on 30 days of note payable should be accrued. (Assume 360 days in a year for calculation)

- Income tax rate is 25%

Johes Trial Balance December 1, 2018 Description 405,653 615,000 Acct 100Cash 01 Accounts Receivable 102 Allowance for Boubtful Accounts 4,600 18,000 00,000 40,600 38,500 3,600 50,000 04 Inventor 105 Prepaid Rent 0Prepaid Insurance 107 Supplies 37,500 ent 27 Truck 56,500 5,875 35,000 75000 130-1 Land 175 Patents 183,300 36,000 201 Accounts Pauable 2203 Utilities Payable 22 204 Payroll Taxes Pauable 23 205 Interest Pauable 2 206 Bividends Pagable 25207 Income Tax Payable 26 208 Note Payable-short term 21 22 Note Payable-long term 28 225 Bond Pajable fnet 8,000 13585 71840 175,000 213,712 Commen Stook, $1par 35,000 shares issued and 301 outstandin 30: 302 APIC Common Stock 31304 Unearned Compensation 32305 Treasuru Stock 33 306 APIC Treasury Stock 34310 Retained Earnings 35 401 Sales 36 500 Cost of Goods Sold 37 600 Compensation Expense 35,000 153.000 45.000 150.000 508979 Select destination and ptesnt itaeh Page Break Page Custom | Mj Gridlines Preview Layout Views Workbook Views Show D51 71,840 175,000 213,712 26 208 Note Pajable short term 35,000 153,000 Common Stock. $1par. 35,000 shares issued and 29 301 outstandin 30302 APIC Common Stock Unearned Compensation 32 305 Treasury Stock 33 306 APIC Treasury Stock 34 310 Retained Earnings 35 401 Sales 36 | 500 | Cost of Goods Sold 37 600 Compensation Expense 38 601 39 602 Rent Expense 45,000 1,150,000 508,979 alaries Expense 45,000 40 604 Bad Dept Expense 41605 Pajroll Tax Ezpense 42 606 Advertisting EX 43 607 Insurance Ezpense 44608 Supplies Expense 7.490 pense 45 609 Depreciation Expense 46 610 Amortization Expense 47 611 Utilities Expense 48 612 Miscellaneous Expenses 49 614 Interest Expense 50 615 Income Tax Expense 51 617 Realized Gains (Losses 52 620 Unrealized Giains (Losses 53 Totals 54 57 59 60 61 Johes Trial Balance December 1, 2018 Description 405,653 615,000 Acct 100Cash 01 Accounts Receivable 102 Allowance for Boubtful Accounts 4,600 18,000 00,000 40,600 38,500 3,600 50,000 04 Inventor 105 Prepaid Rent 0Prepaid Insurance 107 Supplies 37,500 ent 27 Truck 56,500 5,875 35,000 75000 130-1 Land 175 Patents 183,300 36,000 201 Accounts Pauable 2203 Utilities Payable 22 204 Payroll Taxes Pauable 23 205 Interest Pauable 2 206 Bividends Pagable 25207 Income Tax Payable 26 208 Note Payable-short term 21 22 Note Payable-long term 28 225 Bond Pajable fnet 8,000 13585 71840 175,000 213,712 Commen Stook, $1par 35,000 shares issued and 301 outstandin 30: 302 APIC Common Stock 31304 Unearned Compensation 32305 Treasuru Stock 33 306 APIC Treasury Stock 34310 Retained Earnings 35 401 Sales 36 500 Cost of Goods Sold 37 600 Compensation Expense 35,000 153.000 45.000 150.000 508979 Select destination and ptesnt itaeh Page Break Page Custom | Mj Gridlines Preview Layout Views Workbook Views Show D51 71,840 175,000 213,712 26 208 Note Pajable short term 35,000 153,000 Common Stock. $1par. 35,000 shares issued and 29 301 outstandin 30302 APIC Common Stock Unearned Compensation 32 305 Treasury Stock 33 306 APIC Treasury Stock 34 310 Retained Earnings 35 401 Sales 36 | 500 | Cost of Goods Sold 37 600 Compensation Expense 38 601 39 602 Rent Expense 45,000 1,150,000 508,979 alaries Expense 45,000 40 604 Bad Dept Expense 41605 Pajroll Tax Ezpense 42 606 Advertisting EX 43 607 Insurance Ezpense 44608 Supplies Expense 7.490 pense 45 609 Depreciation Expense 46 610 Amortization Expense 47 611 Utilities Expense 48 612 Miscellaneous Expenses 49 614 Interest Expense 50 615 Income Tax Expense 51 617 Realized Gains (Losses 52 620 Unrealized Giains (Losses 53 Totals 54 57 59 60 61

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts