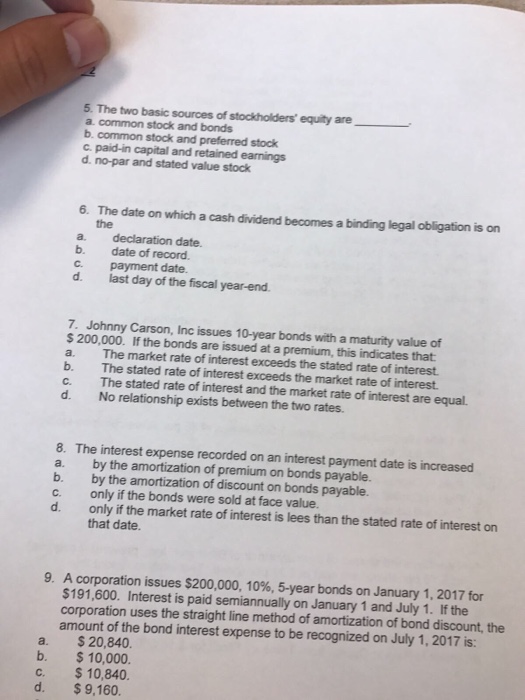

Question: The two basic sources of stockholders' equity are _____ a. common stock and bonds b. common stock and preferred stock c. paid-in capital and retained

The two basic sources of stockholders' equity are _____ a. common stock and bonds b. common stock and preferred stock c. paid-in capital and retained earnings d. no par and stated value stock The date on which a cash dividend becomes a. binding legal obligation is on the a. declaration date. b. date of record. c. payment date. d. last day of the fiscal year-end. Johnny Carson, Inc issues 10-year bonds with a maturity value of $200,000. If the bonds are issued at a premium, this indicates that; a. The market rate of interest exceeds the stated rate of interest. b. The stated rate of interest exceeds the market rate of interest. c. The stated rate of interest and the market rate of interest are equal. d. No relationship exists between the two rates. The interest expense recorded on an interest payment date is increased a. by the amortization of premium on bonds payable. b. by the amortization of discount on bonds payable. c. only if the bonds were sold at face value. d. only if the market rate of interest is less than the stated rate of interest on that date. A corporation issues $200,000, 10%, 5-year bonds on January 1, 2017 for $191, 600. Interest is paid semiannually on January 1 and July 1. if the corporation uses the straight line method of amortization of bond discount, the amount of the bond interest expense to be recognized on July 1, 2017 is: a. 20, 840 b. 10,000 c. 10, 840 d. 9, 160

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts