Question: The two bonds in question: - Bond X: A zero coupon bond with a face value of $1,000 and exactly 8 years remaining that is

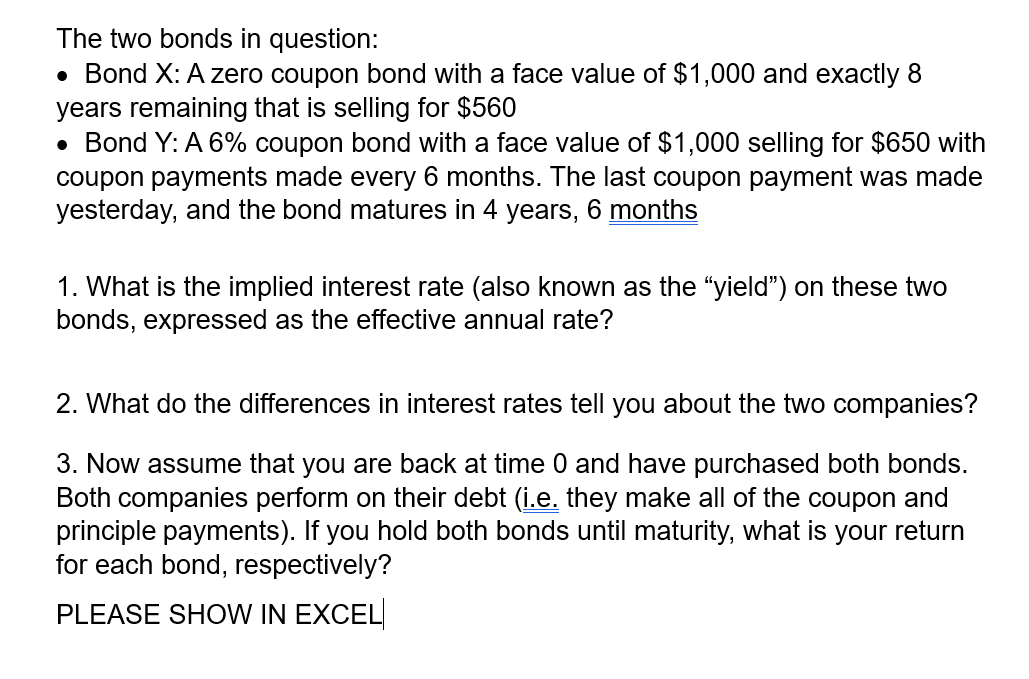

The two bonds in question: - Bond X: A zero coupon bond with a face value of $1,000 and exactly 8 years remaining that is selling for $560 - Bond Y: A 6% coupon bond with a face value of $1,000 selling for $650 with coupon payments made every 6 months. The last coupon payment was made yesterday, and the bond matures in 4 years, 6 months 1. What is the implied interest rate (also known as the "yield") on these two bonds, expressed as the effective annual rate? 2. What do the differences in interest rates tell you about the two companies? 3. Now assume that you are back at time 0 and have purchased both bonds. Both companies perform on their debt (i.e. they make all of the coupon and principle payments). If you hold both bonds until maturity, what is your return for each bond, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts