Question: The two Companies will be Adobe and VMWare Group Project - Assignment 1 (100 Marks) For your two companies refer to their Annual Report to:

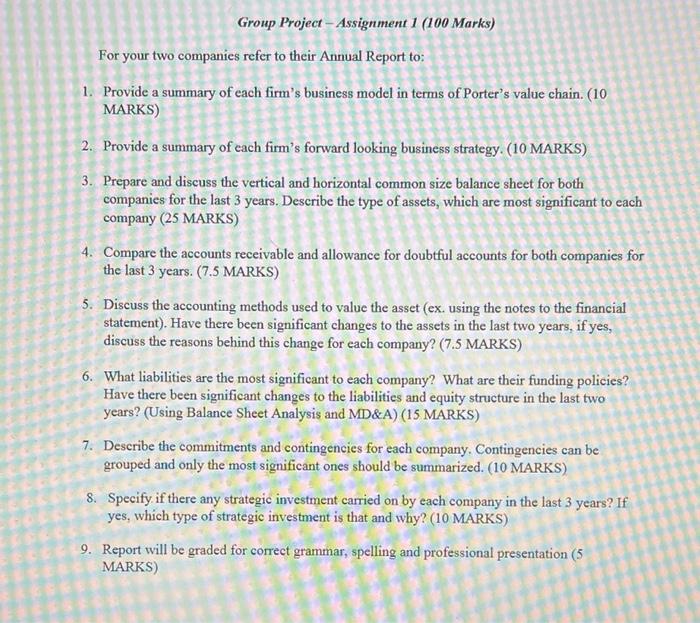

Group Project - Assignment 1 (100 Marks) For your two companies refer to their Annual Report to: 1. Provide a summary of each firm's business model in terms of Porter's value chain. (10 MARKS) 2. Provide a summary of each firm's forward looking business strategy (10 MARKS) 3. Prepare and discuss the vertical and horizontal common size balance sheet for both companies for the last 3 years. Describe the type of assets, which are most significant to each company (25 MARKS) 4. Compare the accounts receivable and allowance for doubtful accounts for both companies for the last 3 years. (7.5 MARKS) 5. Discuss the accounting methods used to value the asset (ex. using the notes to the financial statement). Have there been significant changes to the assets in the last two years, if yes, discuss the reasons behind this change for each company? (7.5 MARKS) 6. What liabilities are the most significant to each company? What are their funding policies? Have there been significant changes to the liabilities and equity structure in the last two years? (Using Balance Sheet Analysis and MD&A) (15 MARKS) 7. Describe the commitments and contingencies for each company. Contingencies can be grouped and only the most significant ones should be summarized. (10 MARKS) 8. Specify, if there any strategic investment carried on by each company in the last 3 years? If yes, which type of strategic investment is that and why? (10 MARKS) 9. Report will be graded for correct grammar, spelling and professional presentation (5 MARKS) Group Project - Assignment 1 (100 Marks) For your two companies refer to their Annual Report to: 1. Provide a summary of each firm's business model in terms of Porter's value chain. (10 MARKS) 2. Provide a summary of each firm's forward looking business strategy (10 MARKS) 3. Prepare and discuss the vertical and horizontal common size balance sheet for both companies for the last 3 years. Describe the type of assets, which are most significant to each company (25 MARKS) 4. Compare the accounts receivable and allowance for doubtful accounts for both companies for the last 3 years. (7.5 MARKS) 5. Discuss the accounting methods used to value the asset (ex. using the notes to the financial statement). Have there been significant changes to the assets in the last two years, if yes, discuss the reasons behind this change for each company? (7.5 MARKS) 6. What liabilities are the most significant to each company? What are their funding policies? Have there been significant changes to the liabilities and equity structure in the last two years? (Using Balance Sheet Analysis and MD&A) (15 MARKS) 7. Describe the commitments and contingencies for each company. Contingencies can be grouped and only the most significant ones should be summarized. (10 MARKS) 8. Specify, if there any strategic investment carried on by each company in the last 3 years? If yes, which type of strategic investment is that and why? (10 MARKS) 9. Report will be graded for correct grammar, spelling and professional presentation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts