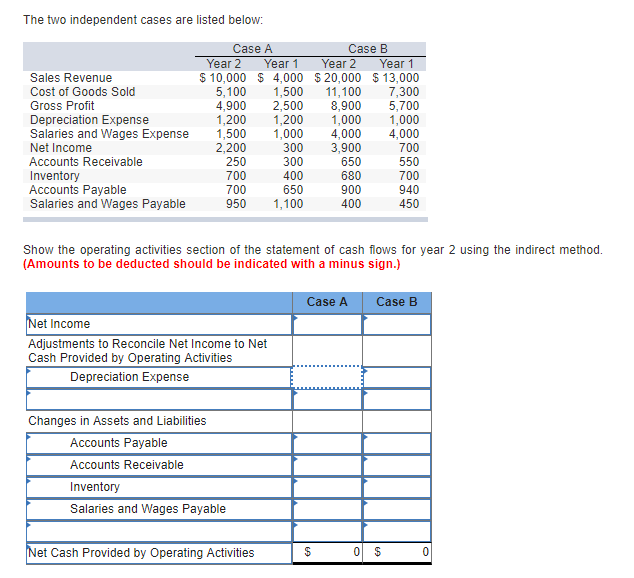

Question: The two independent cases are listed below: Case A Case B Sales Revenue Cost of Goods Sold Gross Profit Depreciation Expense Year 2 Year 1

The two independent cases are listed below: Case A Case B Sales Revenue Cost of Goods Sold Gross Profit Depreciation Expense Year 2 Year 1 Year 2 Year 1 5,100 ,500 11,100 7,300 1,200 1,000 ,000 $10,000 $ 4,000 $ 20,000 $ 13,000 4,900 2,500 8,900 5,700 1,200 Salaries and Wages Expense 1,500 ,000 4,000 4,000 Net Income Accounts Receivable Inventory Accounts Payable Salaries and Wages Payable 300 3,900 650 680 900 400 700 550 700 940 450 2,200 250 700 700 950 1,100 300 400 650 Show the operating activities section of the statement of cash flows for year 2 using the indirect method. (Amounts to be deducted should be indicated with a minus sign.) Case A Case B et Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities Depreciation Expense Changes in Assets and Liabilities Accounts Payable Accounts Receivable Inventory Salaries and Wages Payable et Cash Provided by Operating Activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts