Question: The two questions are both mcq in finance . Please explain each answer in detail , othersiwe upvote will not be granted. 1) Assume the

The two questions are both mcq in finance . Please explain each answer in detail , othersiwe upvote will not be granted.

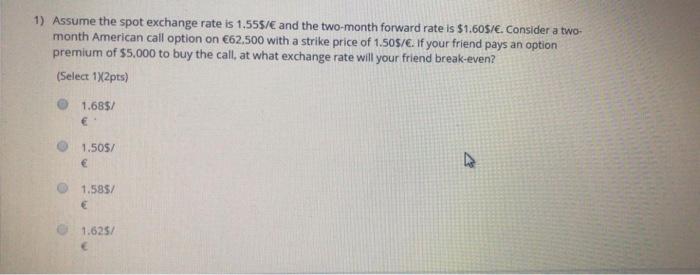

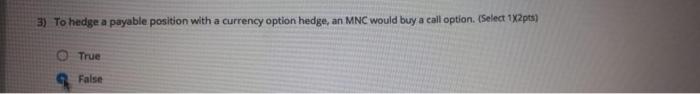

1) Assume the spot exchange rate is 1.555/ and the two-month forward rate is $1.605/. Consider a two- month American call option on 62,500 with a strike price of 1.505/6. If your friend pays an option premium of $5,000 to buy the call, at what exchange rate will your friend break-even? (Select 1X2pts) 1.685/ 1.50$/ 1.585/ 1.625/ 3) To hedge a payable position with a currency option hedge, an MNC would buy a call option. (Select 1x2pts) True False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock