Question: the two questions below have some error. plz help me correct these errors. thanks! A company had sales of $600 and costs of $300. Depreciation

the two questions below have some error. plz help me correct these errors. thanks!

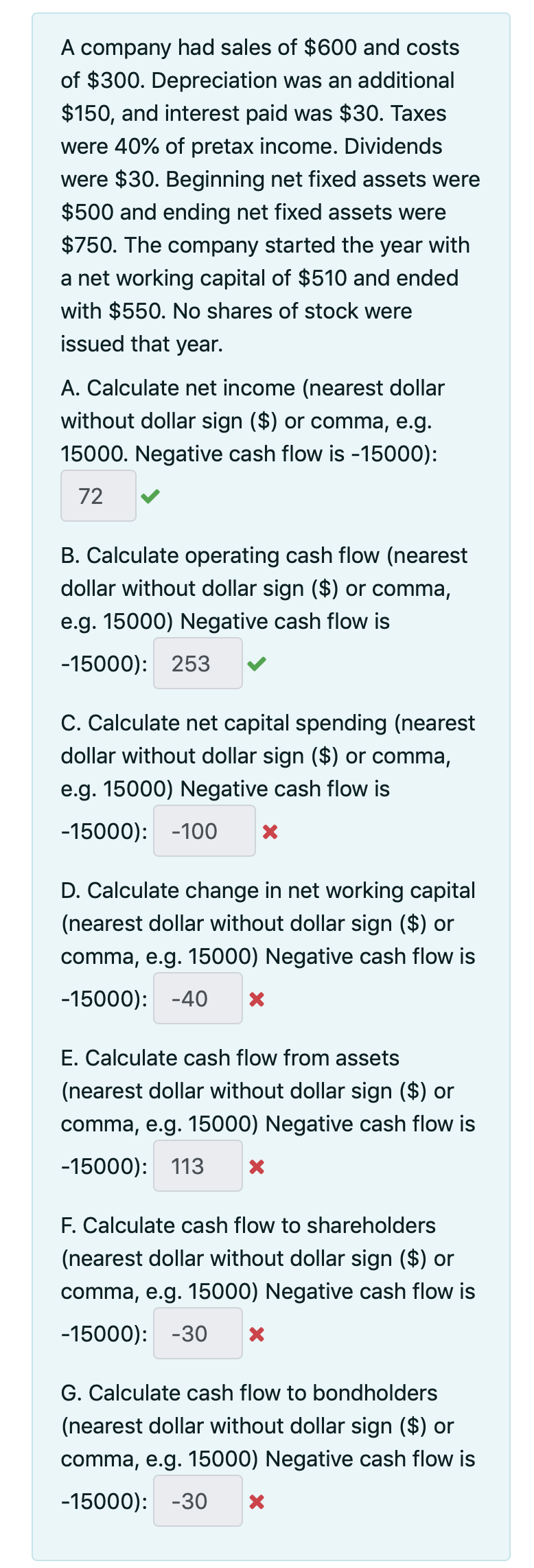

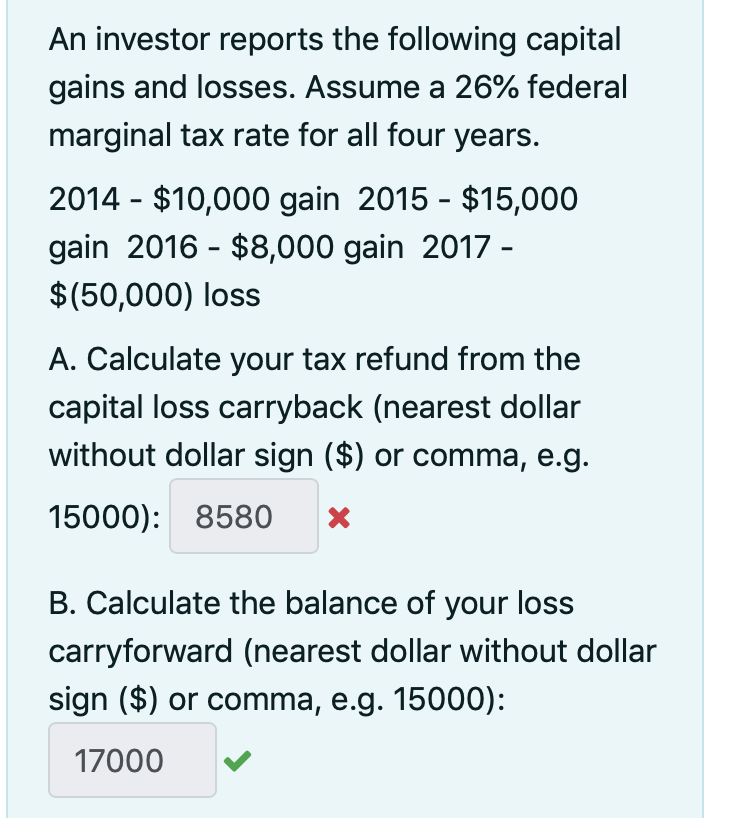

A company had sales of $600 and costs of $300. Depreciation was an additional $150, and interest paid was $30. Taxes were 40% of pretax income. Dividends were $30. Beginning net fixed assets were $500 and ending net fixed assets were $750. The company started the year with a net working capital of $510 and ended with $550. No shares of stock were issued that year. A. Calculate net income (nearest dollar without dollar sign ($) or comma, e.g. 15000. Negative cash flow is -15000): 72 B. Calculate operating cash flow (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): 253 C. Calculate net capital spending (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): -100 X D. Calculate change in net working capital (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): -40 X E. Calculate cash flow from assets (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): 113 X F. Calculate cash flow to shareholders (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): -30 x G. Calculate cash flow to bondholders (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): -30 x An investor reports the following capital gains and losses. Assume a 26% federal marginal tax rate for all four years. 2014 - $10,000 gain 2015 - $15,000 gain 2016 - $8,000 gain 2017 - $(50,000) loss A. Calculate your tax refund from the capital loss carryback (nearest dollar without dollar sign ($) or comma, e.g. 15000): 8580 X B. Calculate the balance of your loss carryforward (nearest dollar without dollar sign ($) or comma, e.g. 15000): 17000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts