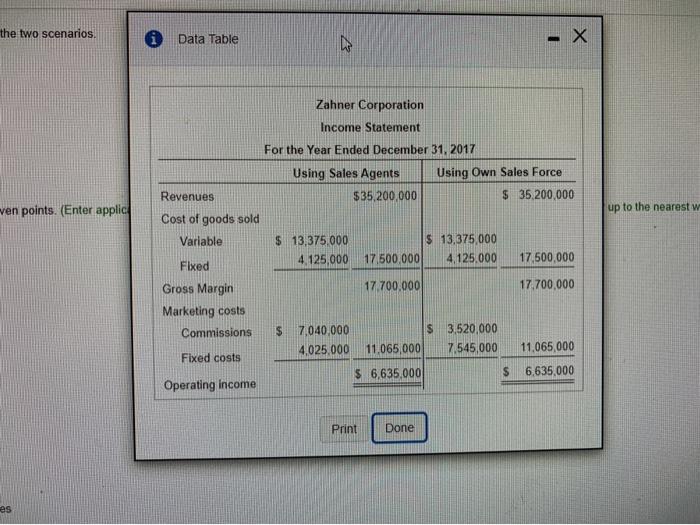

Question: the two scenarios. Data Table X ven points. (Enter applic up to the nearest w Zahner Corporation Income Statement For the Year Ended December 31,

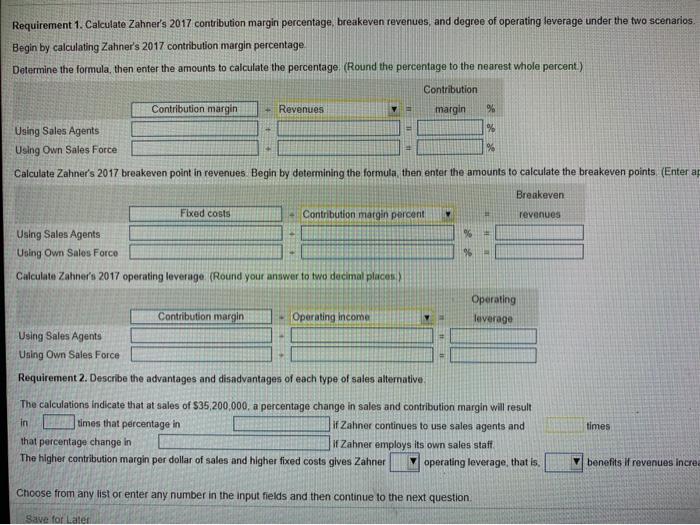

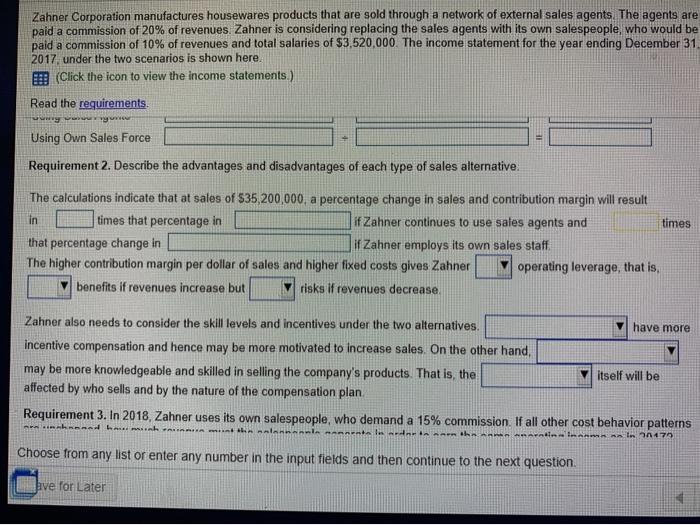

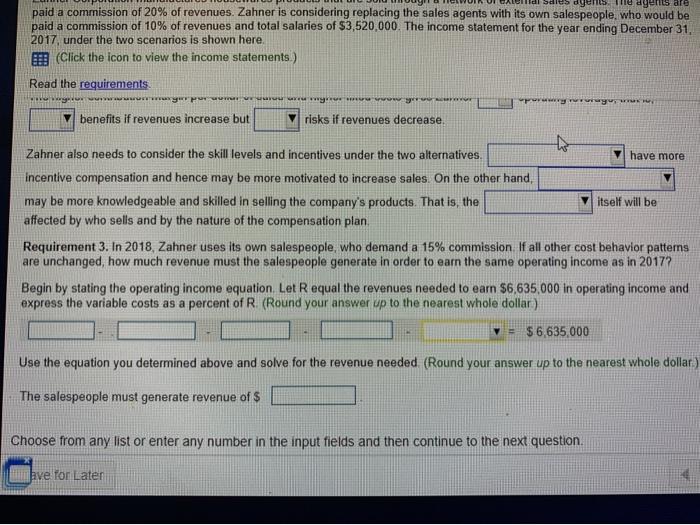

the two scenarios. Data Table X ven points. (Enter applic up to the nearest w Zahner Corporation Income Statement For the Year Ended December 31, 2017 Using Sales Agents Using Own Sales Force Revenues $35,200.000 $ 35,200,000 Cost of goods sold Variable $ 13,375.000 $ 13,375,000 Fixed 4.125,000 17.500,000 4.125.000 17,500,000 Gross Margin 17 700.000 17,700,000 Marketing costs Commissions $ 7,040,000 $ 3,520,000 4.025.000 11.065,000 7.545,000 11,065,000 Fixed costs $ 6,635,000 $ 6,635,000 Operating income Print Done es 1 Requirement 1. Calculate Zahner's 2017 contribution margin percentage breakeven revenues, and degree of operating leverage under the two scenarios. Begin by calculating Zahner's 2017 contribution margin percentage Determine the formula, then enter the amounts to calculate the percentage. (Round the percentage to the nearest whole percent.) Contribution Contribution margin Revenues margin 9 Using Sales Agents % Using Own Sales Force % Calculate Zahner's 2017 breakeven point in revenues Begin by determining the formula, then enter the amounts to calculate the breakeven points (Enter a Breakeven Fixed costs Contribution margin percent revenues Using Sales Agents Using Own Sales Force Calculate Zahner's 2017 operating leverage (Round your answer to two decimal places> Operating leverage Contribution margin Operating income Using Sales Agents Using Own Sales Force Requirement 2. Describe the advantages and disadvantages of each type of sales alternative times The calculations indicate that at sales of $35,200,000, a percentage change in sales and contribution margin will result in times that percentage in if Zahner continues to use sales agents and that percentage change in if Zahner employs its own sales staff The higher contribution margin per dollar of sales and higher fixed costs gives Zahner M operating leverage, that is V benefits if revenues incre Choose from any list or enter any number in the input fields and then continue to the next question Save for Later Zahner Corporation manufactures housewares products that are sold through a network of external sales agents. The agents are paid a commission of 20% of revenues Zahner is considering replacing the sales agents with its own salespeople, who would be paid a commission of 10% of revenues and total salaries of $3,520,000. The income statement for the year ending December 31 2017. under the two scenarios is shown here. E (Click the icon to view the income statements.) Read the requirements. wy Using Own Sales Force Requirement 2. Describe the advantages and disadvantages of each type of sales alternative The calculations indicate that at sales of $35,200,000, a percentage change in sales and contribution margin will result in times that percentage in if Zahner continues to use sales agents and times that percentage change in if Zahner employs its own sales staff The higher contribution margin per dollar of sales and higher fixed costs gives Zahner operating leverage, that is, benefits if revenues increase but risks if revenues decrease Zahner also needs to consider the skill levels and incentives under the two alternatives, have more incentive compensation and hence may be more motivated to increase sales. On the other hand, may be more knowledgeable and skilled in selling the company's products. That is, the itself will be affected by who sells and by the nature of the compensation plan Requirement 3. In 2018, Zahner uses its own salespeople, who demand a 15% commission. If all other cost behavior patterns nnnnn .. talenten haluan 47 Choose from any list or enter any number in the input fields and then continue to the next question have for Later e agents are paid a commission of 20% of revenues. Zahner is considering replacing the sales agents with its own salespeople who would be paid a commission of 10% of revenues and total salaries of $3,520,000. The income statement for the year ending December 31, 2017, under the two scenarios is shown here, (Click the icon to view the income statements.) Read the requirements H wwwwwwwwwwwww org www benefits if revenues increase but risks if revenues decrease. Zahner also needs to consider the skill levels and incentives under the two alternatives. have more incentive compensation and hence may be more motivated to increase sales. On the other hand, may be more knowledgeable and skilled in selling the company's products. That is, the itself will be affected by who sells and by the nature of the compensation plan Requirement 3. In 2018, Zahner uses its own salespeople who demand a 15% commission If all other cost behavior patterns are unchanged, how much revenue must the salespeople generate in order to earn the same operating income as in 2017? Begin by stating the operating income equation Let R equal the revenues needed to earn $6,635,000 in operating income and express the variable costs as a percent of R (Round your answer up to the nearest whole dollar) v = $6,635,000 Use the equation you determined above and solve for the revenue needed (Round your answer up to the nearest whole dollar.) The salespeople must generate revenue of $ Choose from any list or enter any number in the input fields and then continue to the next question. have for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts