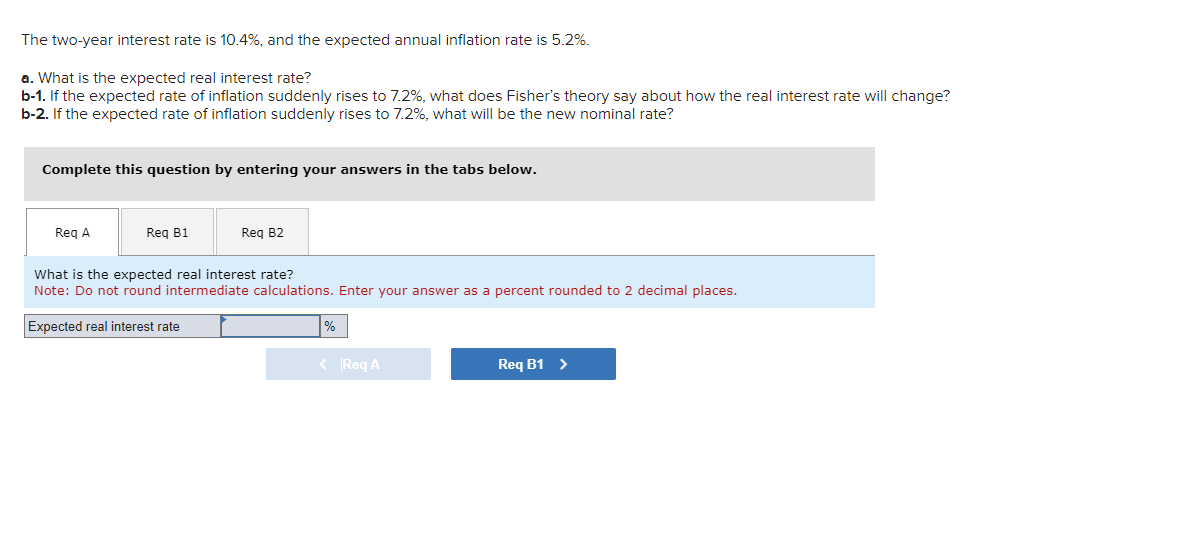

Question: The two - year interest rate is 1 0 . 4 % , and the expected annual inflation rate is 5 . 2 % .

The twoyear interest rate is and the expected annual inflation rate is

a What is the expected real interest rate?

b If the expected rate of inflation suddenly rises to what does Fisher's theory say about how the real interest rate will change?

If the expected rate of inflation suddenly rises to what will be the new nominal rate?

Complete this question by entering your answers in the tabs below.

Req B

What is the expected real interest rate?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to decimal places.

Expected real interest rate

The twoyear interest rate is and the expected annual inflation rate is

a What is the expected real interest rate?

b If the expected rate of inflation suddenly rises to what does Fishers theory say about how the real interest rate will change?

b If the expected rate of inflation suddenly rises to what will be the new nominal rate?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock