Question: During 2024, Yellow Card constructed a small manu- facturing facility specifically to manufacture one particular accessory. YellowCard paid the construction contractor $5,000,000 cash (which

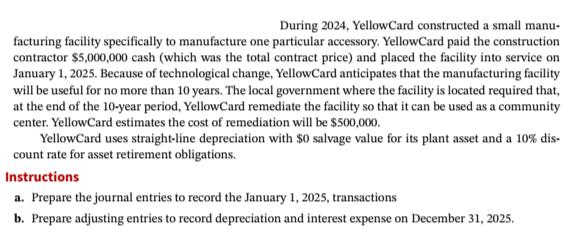

During 2024, Yellow Card constructed a small manu- facturing facility specifically to manufacture one particular accessory. YellowCard paid the construction contractor $5,000,000 cash (which was the total contract price) and placed the facility into service on January 1, 2025. Because of technological change, YellowCard anticipates that the manufacturing facility will be useful for no more than 10 years. The local government where the facility is located required that, at the end of the 10-year period, YellowCard remediate the facility so that it can be used as a community center. YellowCard estimates the cost of remediation will be $500,000. Yellow Card uses straight-line depreciation with $0 salvage value for its plant asset and a 10% dis- count rate for asset retirement obligations. Instructions a. Prepare the journal entries to record the January 1, 2025, transactions b. Prepare adjusting entries to record depreciation and interest expense on December 31, 2025.

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

a Construction contractor 5000000 ... View full answer

Get step-by-step solutions from verified subject matter experts