Question: The US Treasury issues Inflation-Protected Securities, also known as TIPS. TIPS are issued with maturities of 5, 10, and 30 years and are considered a

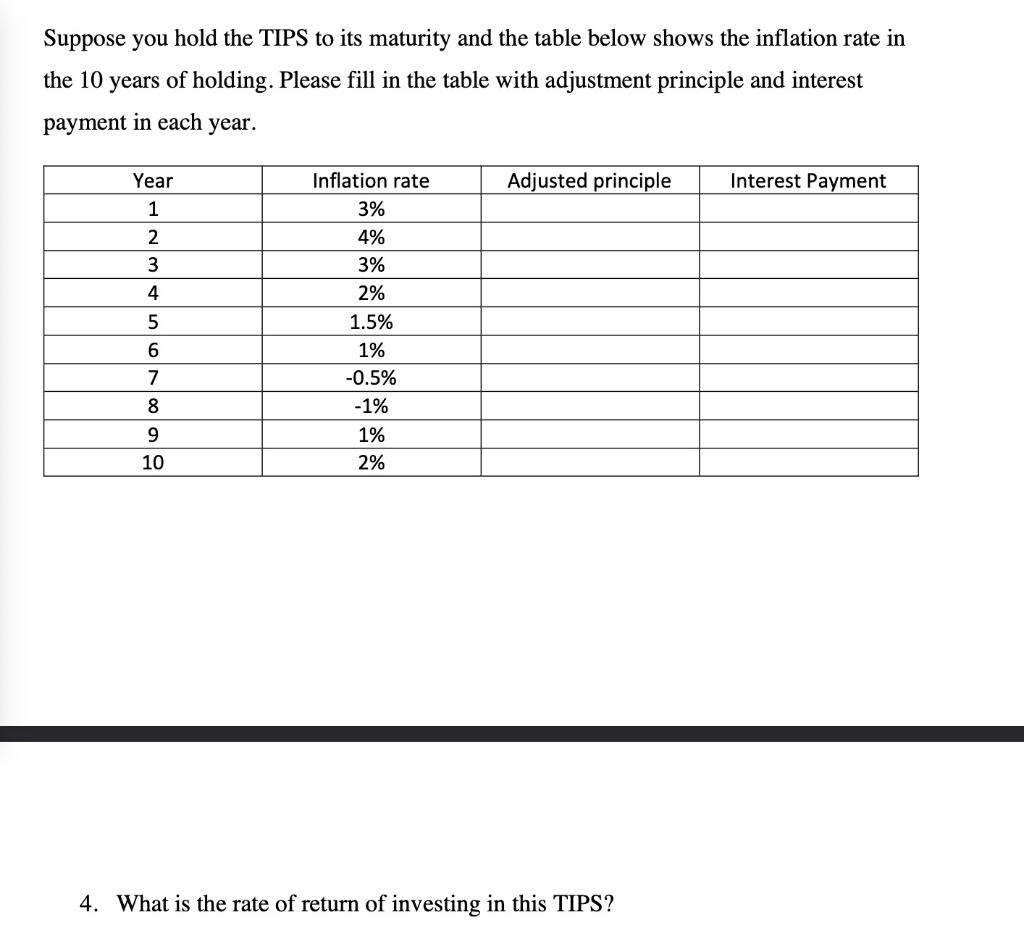

The US Treasury issues Inflation-Protected Securities, also known as TIPS. TIPS are issued with maturities of 5, 10, and 30 years and are considered a low-risk investment because the U.S. government backs them. The principal TIPS is tied to the Consumer Price Index, which is measured by the non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers (CPI-U) published by the Bureau of Labor Statistics of the U.S. Department of Labor. With inflation, the principal increases. With deflation, it decreases. When the security matures, the U.S. Treasury pays the original or adjusted principal, whichever is greater. Suppose you hold the TIPS to its maturity and the table below shows the inflation rate in the 10 years of holding. Please fill in the table with adjustment principle and interest payment in each year. Adjusted principle Interest Payment Year 1 2 3 4 Inflation rate 3% 4% 3% 2% 1.5% 1% -0.5% -1% 5 6 7 8 9 10 1% 2% 4. What is the rate of return of investing in this TIPS? The US Treasury issues Inflation-Protected Securities, also known as TIPS. TIPS are issued with maturities of 5, 10, and 30 years and are considered a low-risk investment because the U.S. government backs them. The principal TIPS is tied to the Consumer Price Index, which is measured by the non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers (CPI-U) published by the Bureau of Labor Statistics of the U.S. Department of Labor. With inflation, the principal increases. With deflation, it decreases. When the security matures, the U.S. Treasury pays the original or adjusted principal, whichever is greater. Suppose you hold the TIPS to its maturity and the table below shows the inflation rate in the 10 years of holding. Please fill in the table with adjustment principle and interest payment in each year. Adjusted principle Interest Payment Year 1 2 3 4 Inflation rate 3% 4% 3% 2% 1.5% 1% -0.5% -1% 5 6 7 8 9 10 1% 2% 4. What is the rate of return of investing in this TIPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts