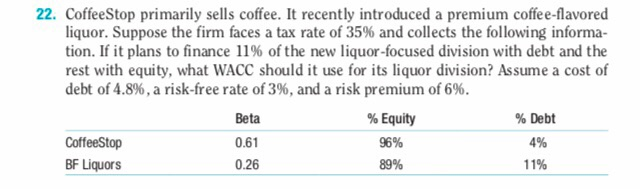

Question: The WACC IS 4.40%. Please explain with formulas . 22. CoffeeStop primarily sells coffee. It recently introduced a premium coffee-flavored liquor. Suppose the firm faces

22. CoffeeStop primarily sells coffee. It recently introduced a premium coffee-flavored liquor. Suppose the firm faces a tax rate of 35% and collects the following informa- tion. If it plans to finance 11% of the new liquor-focused division with debt and the rest with equity, what WACC should it use for its liquor division? Assume a cost of debt of 4.8%, a risk-free rate of 396, and a risk premium of 6%. CoffeeStop BF Liquors Beta 0.61 0.26 % Equity 96% 89% % Debt 4% 11%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts