Question: The weak form of the efficient - market hypothesis asserts that Mutople Choice stock prices do not rapidy adjust to new information cortained in past

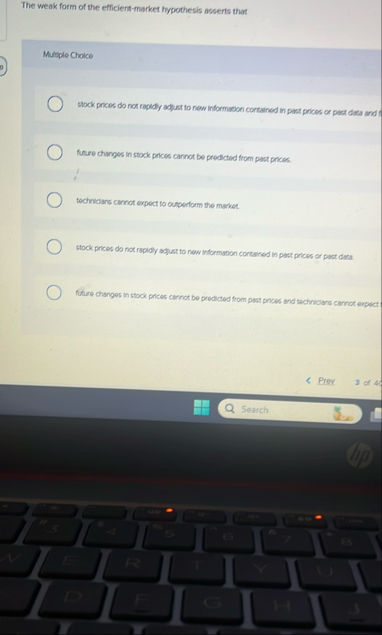

The weak form of the efficientmarket hypothesis asserts that

Mutople Choice

stock prices do not rapidy adjust to new information cortained in past prices or past dats and if

fuere changes in stock prices carror be predicted from past prices.

techricans carnot expect to outperform the market.

stock prices do not rapidy adust to new information cortained in past prices or past dats.

flure changes in stock prices carrort be prodated from part prices and technicars carrot expect

Prey

of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock