Question: The whole question is here Problem #1 (30 marks) Industry Prepare a ratio analysis for Halifax Sports Inc. using an excel spreadsheet. The firm has

The whole question is here

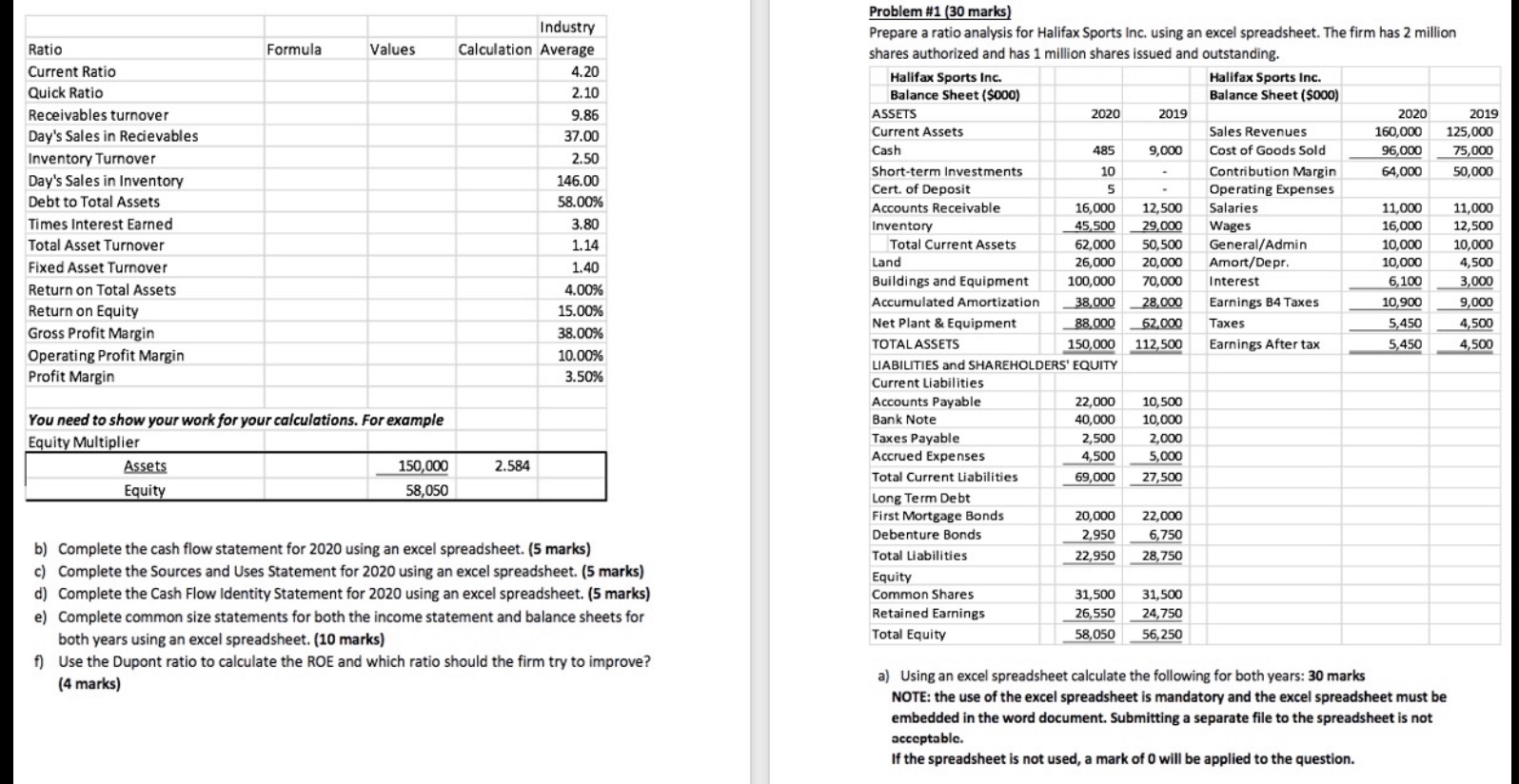

Problem #1 (30 marks) Industry Prepare a ratio analysis for Halifax Sports Inc. using an excel spreadsheet. The firm has 2 million Ratio Formula Values Calculation Average shares authorized and has 1 million shares issued and outstanding. Current Ratio 4.20 Halifax Sports Inc. Halifax Sports Inc. Quick Ratio 2.10 Balance Sheet ($000) Balance Sheet ($000) Receivables turnover 9.86 ASSETS 2020 2019 2020 2019 Sales Revenues Day's Sales in Recievables Current Assets 160,000 125,000 37.00 Cash 485 9,000 Cost of Goods Sold 96,000 75,000 Inventory Turnover 2.50 Short-term Investments 10 Contribution Margin 64,000 50,000 Day's Sales in Inventory 146.00 Cert. of Deposit 5 Operating Expenses Debt to Total Assets 58.00% Accounts Receivable 16,000 12,500 Salaries 11,000 11,000 Times Interest Earned 3.80 Inventory 45,500 29,000 Wages 16,000 12,500 1.14 Total Current Assets 62,000 50,500 General/Admin 10,000 10,000 Total Asset Turnover 1.40 Land 26,000 20,000 Amort/Depr. 10,000 4,500 Fixed Asset Turnover Buildings and Equipment 100,000 70,000 Interest 6,100 3,000 Return on Total Assets 4.00% Accumulated Amortization 38,000 28,000 Earnings B4 Taxes 10,900 9,000 Return on Equity 15.00% Net Plant & Equipment 88.000 62,000 Taxes 5,450 4,500 Gross Profit Margin 38.00% TOTALASSETS 150,000 112,500 Earnings After tax 5,450 4,500 Operating Profit Margin 10.00% LIABILITIES and SHAREHOLDERS' EQUITY Profit Margin 3.50% Current Liabilities Accounts Payable 22,000 10,500 You need to show your work for your calculations. For example Bank Note 40,000 10,000 2,500 Equity Multiplier Taxes Payable 2,000 Accrued Expenses 4,500 5,000 Assets 150,000 2.584 Total Current Liabilities 69,000 27,500 Equity 58,050 Long Term Debt First Mortgage Bonds 20,000 22,000 Debenture Bonds 2,950 6,750 b) Complete the cash flow statement for 2020 using an excel spreadsheet. (5 marks) Total Liabilities 22,950 28,750 c) Complete the Sources and Uses Statement for 2020 using an excel spreadsheet. (5 marks) Equity d) Complete the Cash Flow Identity Statement for 2020 using an excel spreadsheet. (5 marks) Common Shares 31,500 31,500 e) Complete common size statements for both the income statement and balance sheets for Retained Earnings 26,550 24,750 Total Equity 58,050 56,250 both years using an excel spreadsheet. (10 marks) f) Use the Dupont ratio to calculate the ROE and which ratio should the firm try to improve? a) Using an excel spreadsheet calculate the following for both years: 30 marks (4 marks) NOTE: the use of the excel spreadsheet is mandatory and the excel spreadsheet must be embedded in the word document. Submitting a separate file to the spreadsheet is not acceptable. If the spreadsheet is not used, a mark of O will be applied to the