Question: The workbook example has a ledger with 3 entries, and it doesn't really provide much information on how to set this up. I'm not good

The workbook example has a ledger with 3 entries, and it doesn't really provide much information on how to set this up. I'm not good with setting up these advanced ledgers. Request some assistance with for formulas to help me understand. Please and thank you!

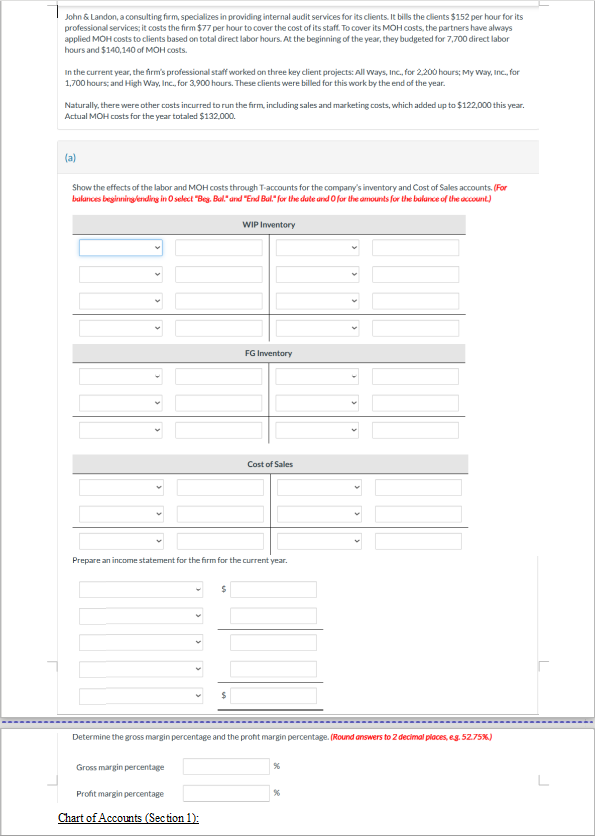

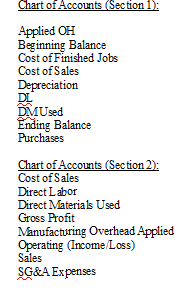

John \& Landon, a consulting firm, specializes in providing internal audit services for its clients. It bills the clients $152 per hour for its professional services, it costs the firm $77 per hour to cover the cost of its staft. To cover its MOH costs, the partners have always applied MOH costs to clients based on total direct labor hours. At the beginning of the year, they budgeted for 7,700 direct labor hours and $140,140 of MOH casts. In the current year, the firm's professional staff worked on three key client projects: All ways, Inc., for 2,200 hours; My way, Inc., for 1,700 hours; and High Way, Inc., for 3,900 hours. These clients were billed for this work by the end of the year. Naturally, there were other costs incurred to run the firm, including sales and marketing costs, which added up to $122,000 this year. Actual MOH costs for the year totaled $132,000. (a) Show the effects of the labor and MOH costs through T-accounts for the compary's inventory and Cost of Sales accounts. (For bulanices beginnirgyending in O selixt "Beg, Bol." and "End Bul." for the dute and Ofor the amounts for the bulurice of the ococunt) Chart of Accounts (Section 1): Applied OH Beginning Balance Cost of Finished Jobs Cost of Sales Depreciation DL DMUsed Ending Balance Purchases Chart of Accounts (Section 2): Cost of Sales Direct L abor Direct Materials Used Gross Profit Manufacturing Overhead Applied Operating (Income/Loss) Sales SG\&A Expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts