Question: The worksheet below presents some information about a project you are asked to evaluate. The project has a two - year economic life. It entails

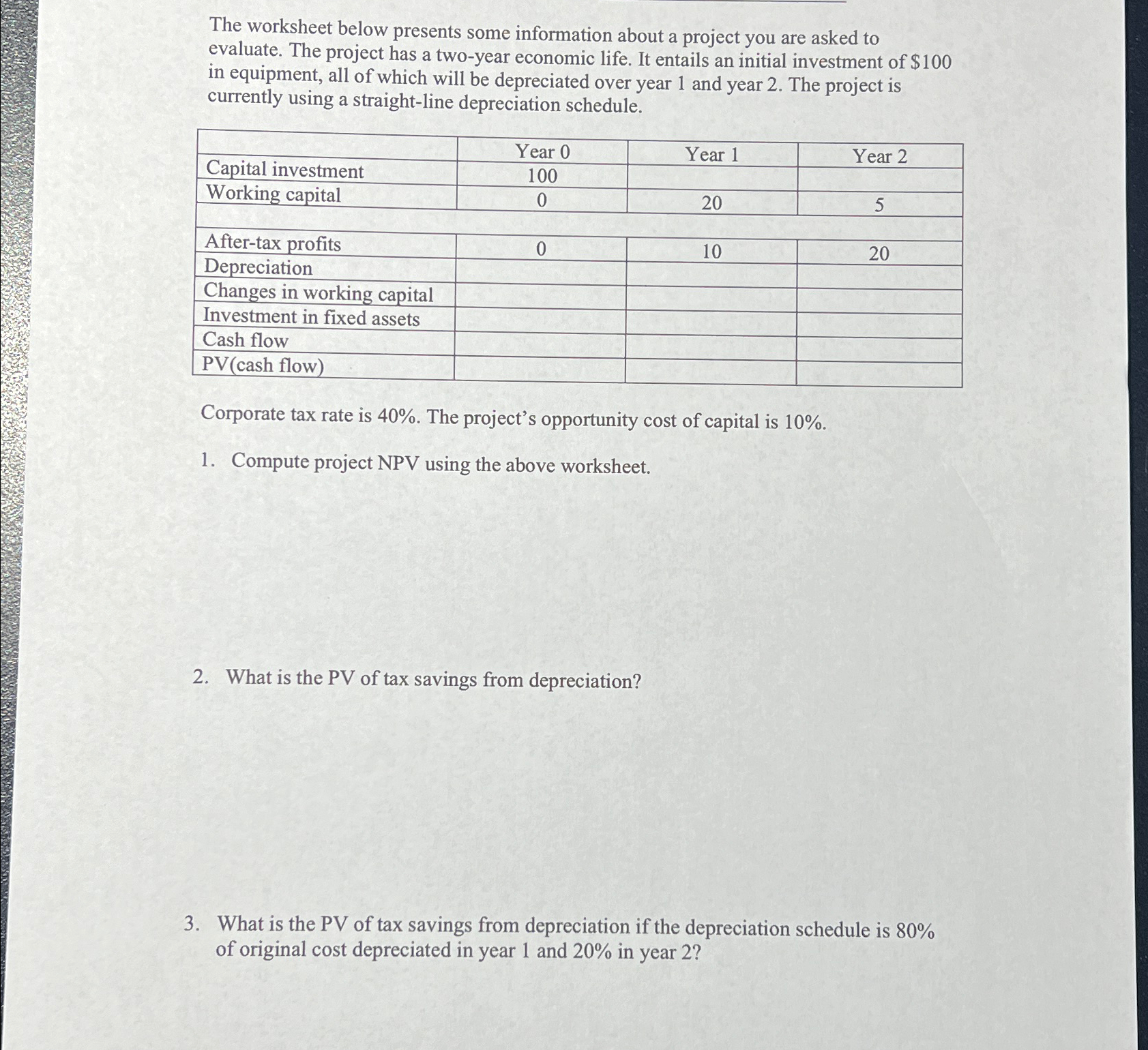

The worksheet below presents some information about a project you are asked to evaluate. The project has a twoyear economic life. It entails an initial investment of $ in equipment, all of which will be depreciated over year and year The project is currently using a straightline depreciation schedule.

tableYear Year Year Capital investment,Working capital,Aftertax profits,DepreciationChanges in working capital,,,Investment in fixed assets,,,Cash flow,,,PVcash flow

Corporate tax rate is The project's opportunity cost of capital is

Compute project NPV using the above worksheet.

What is the of tax savings from depreciation?

What is the PV of tax savings from depreciation if the depreciation schedule is of original cost depreciated in year and in year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock