Question: The yield curve we discussed in the class is based on zero coupon rates, the yield (to maturity) of a bond that does not

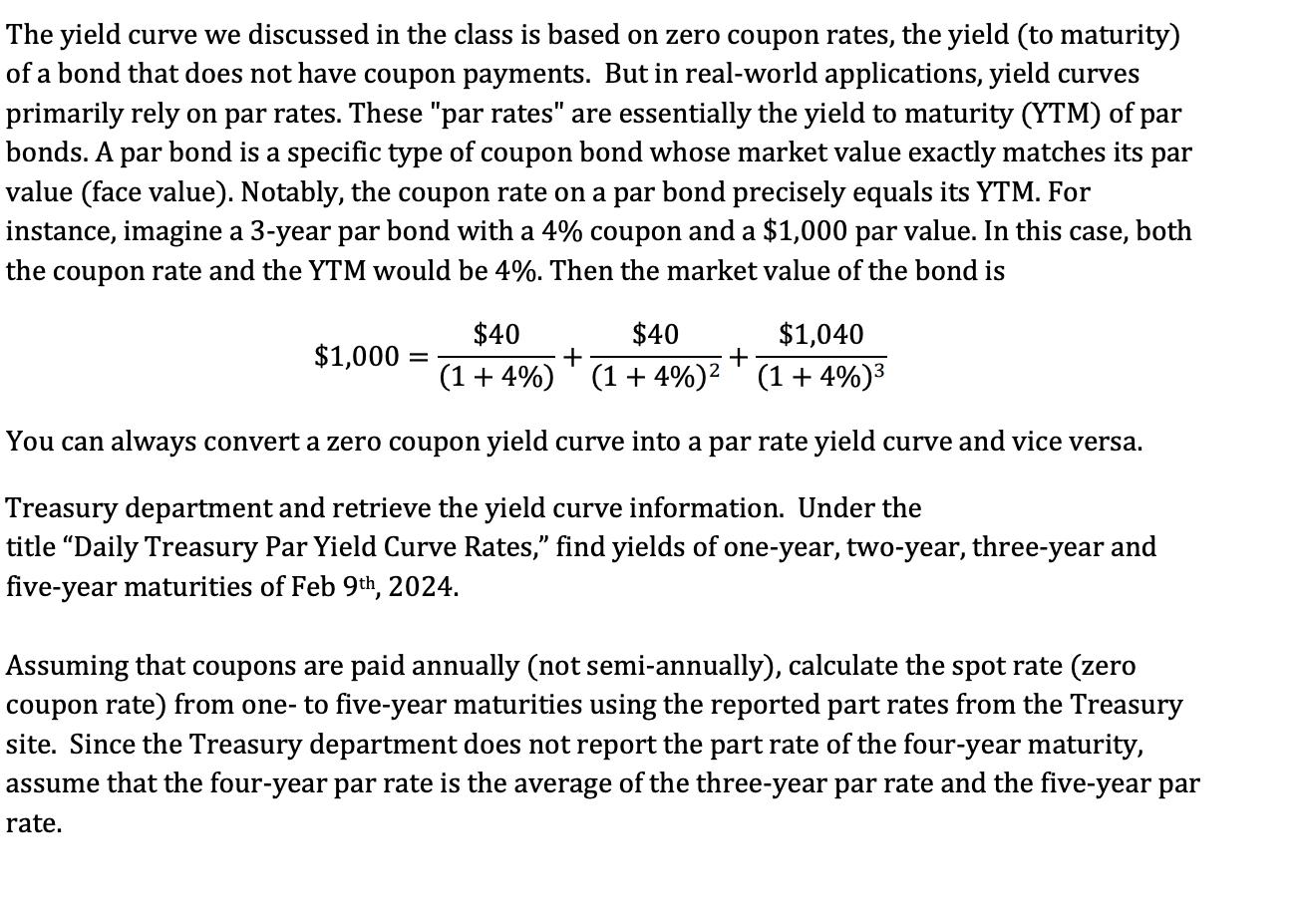

The yield curve we discussed in the class is based on zero coupon rates, the yield (to maturity) of a bond that does not have coupon payments. But in real-world applications, yield curves primarily rely on par rates. These "par rates" are essentially the yield to maturity (YTM) of par bonds. A par bond is a specific type of coupon bond whose market value exactly matches its par value (face value). Notably, the coupon rate on a par bond precisely equals its YTM. For instance, imagine a 3-year par bond with a 4% coupon and a $1,000 par value. In this case, both the coupon rate and the YTM would be 4%. Then the market value of the bond is $1,000 = $40 (1+4%) + $40 (1+4%) + $1,040 (1+4%) You can always convert a zero coupon yield curve into a par rate yield curve and vice versa. Treasury department and retrieve the yield curve information. Under the title "Daily Treasury Par Yield Curve Rates," find yields of one-year, two-year, three-year and five-year maturities of Feb 9th, 2024. Assuming that coupons are paid annually (not semi-annually), calculate the spot rate (zero coupon rate) from one- to five-year maturities using the reported part rates from the Treasury site. Since the Treasury department does not report the part rate of the four-year maturity, assume that the four-year par rate is the average of the three-year par rate and the five-year par rate.

Step by Step Solution

There are 3 Steps involved in it

Finding Spot Rates from Par Yields on Feb 9th 2024 Heres what you need to do Locate Daily Treasury P... View full answer

Get step-by-step solutions from verified subject matter experts