Question: the yield on 10-year Treasury notes is 2% and the expected company's weighted average cost of capital (WACC) common stock in its capital structure? market

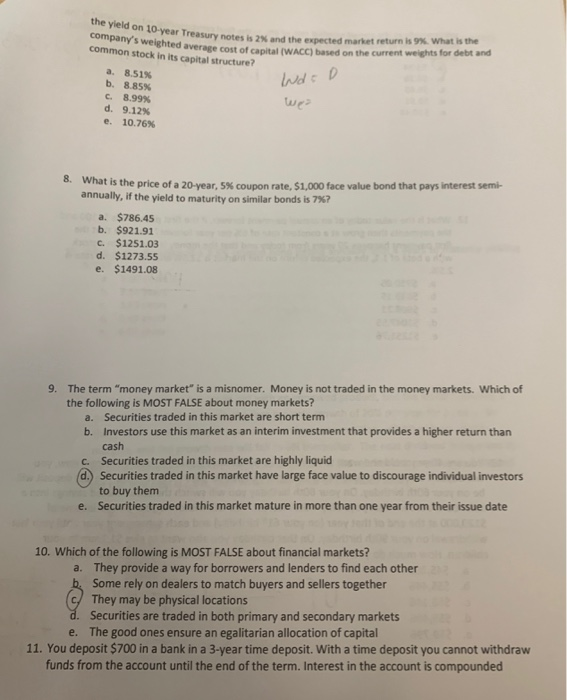

the yield on 10-year Treasury notes is 2% and the expected company's weighted average cost of capital (WACC) common stock in its capital structure? market return is 9% what is the based on the current weights for debt and a. 8.51% b. 8.85% c. 8.99% d. 9.12% e. 10.76% What is the price of a 20-year, 5% coupon rate, $1,000 face value bond that pays interest sent annually, if the yield to maturity on similar bonds is 7%? 8, a. $786.45 b. S921.91 c. $1251.03 d. $1273.55 e. $1491.08 The term "money market" is a misnomer. the following is MOST FALSE about money markets? Money is not traded in the money markets. Which of 9. Securities traded in this market are short term Investors use this market as an interim investment that provides a higher return than cash a. b. c. Securities traded in this market are highly liquid d.) Securities traded in this market have large face value to discourage individual investors to buy them Securities traded in this market mature in more than one year from their issue date e. 10. Which of the following is MOST FALSE about financial markets? They provide a way for borrowers and lenders to find each other Some rely on dealers to match buyers and sellers together They may be physical locations Securities are traded in both primary and secondary markets The good ones ensure an egalitarian allocation of capital a. e. 11. You deposit $700 in a bank in a 3-year time deposit. With a time deposit you cannot withdraw funds from the account until the end of the term. Interest in the account is compounded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts