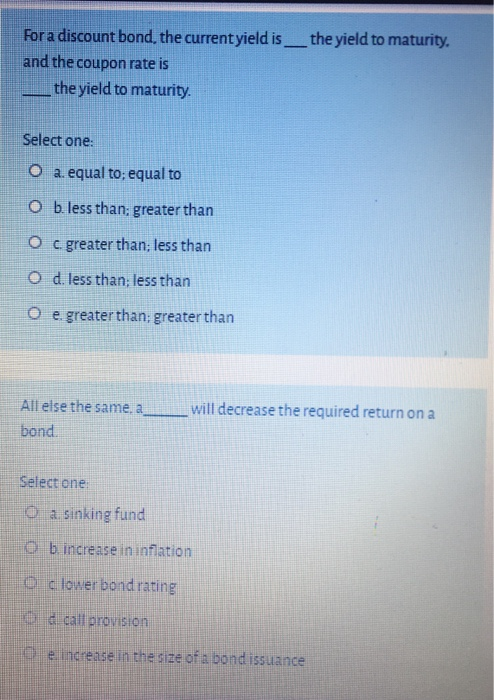

Question: the yield to maturity. For a discount bond, the current yield is and the coupon rate is the yield to maturity. Select one: O a.

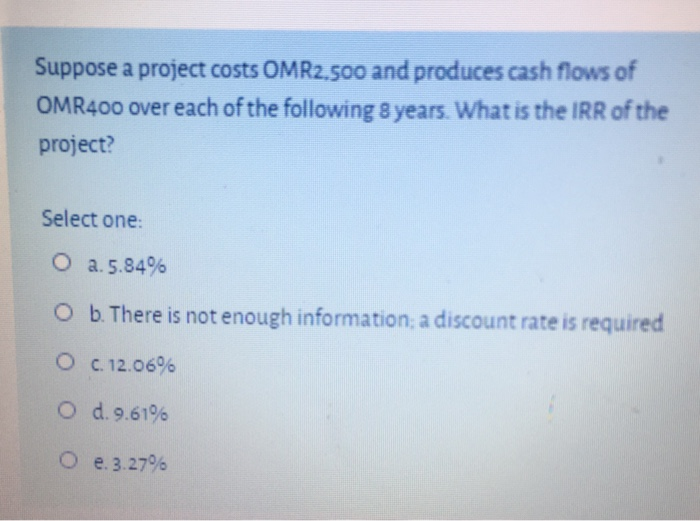

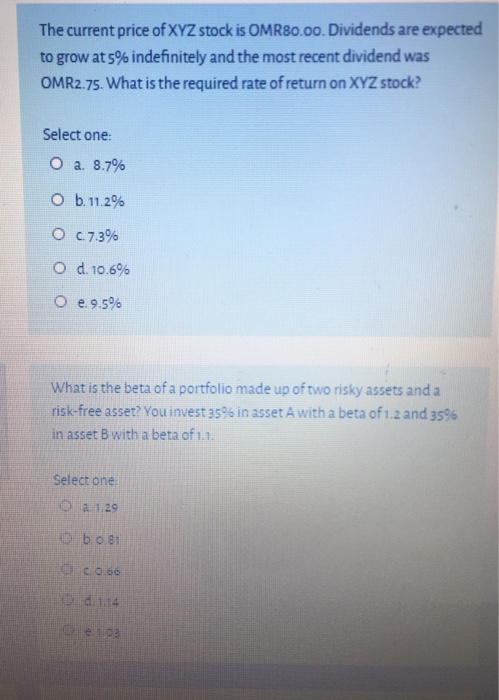

the yield to maturity. For a discount bond, the current yield is and the coupon rate is the yield to maturity. Select one: O a. equal to; equal to O b. less than: greater than O c greater than; less than 0 d. less than; less than O e greater than greater than All else the same, a bond. will decrease the required return on a Select one a sinking fund Ob increase in inflation o cloner bondrating e call provision e increase in the size of a bond issuance Suppose a project costs OMR2.500 and produces cash flows of OMR400 over each of the following 8 years. What is the IRR of the project? Select one: O a. 5.84% O b. There is not enough information; a discount rate is required O C. 12.06% O d. 9.61% O e. 3.27% The current price of XYZ stock is OMR80.00. Dividends are expected to grow at 5% indefinitely and the most recent dividend was OMR2.75. What is the required rate of return on XYZ stock? Select one: O a. 8.7% O b. 11.2% O c.7.3% O d. 10.6% O e. 9.5% What is the beta of a portfolio made up of two risky assets and a risk-free asser? You invest 35% in asset A with a beta of 1.2 and 35% in asset B with a beta of 1.1. Select one: 0 a 1.29 0 b 0.81 d. 112 e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts