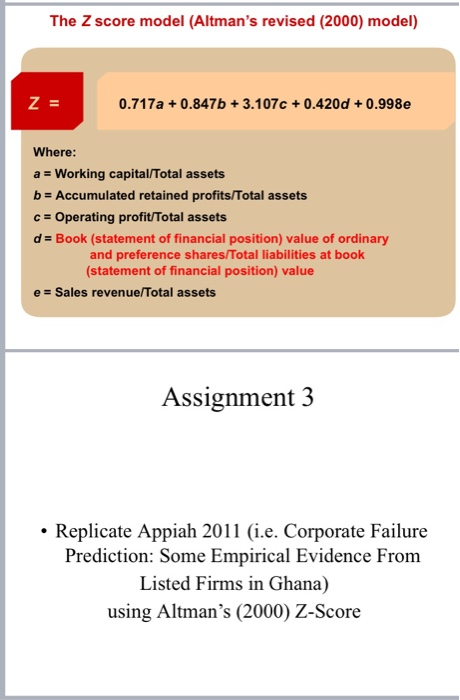

Question: The Z score model (Altman's revised (2000) model) Z = 0.717a + 0.847b + 3.107c + 0.420d +0.998e Where: a = Working capital/Total assets b

The Z score model (Altman's revised (2000) model) Z = 0.717a + 0.847b + 3.107c + 0.420d +0.998e Where: a = Working capital/Total assets b = Accumulated retained profits/Total assets c = Operating profit/Total assets d = Book (statement of financial position) value of ordinary and preference shares/Total liabilities at book (statement of financial position) value e = Sales revenue/Total assets Assignment 3 Replicate Appiah 2011 (i.e. Corporate Failure Prediction: Some Empirical Evidence from Listed Firms in Ghana) using Altman's (2000) Z-Score The Z score model (Altman's revised (2000) model) Z = 0.717a + 0.847b + 3.107c + 0.420d +0.998e Where: a = Working capital/Total assets b = Accumulated retained profits/Total assets c = Operating profit/Total assets d = Book (statement of financial position) value of ordinary and preference shares/Total liabilities at book (statement of financial position) value e = Sales revenue/Total assets Assignment 3 Replicate Appiah 2011 (i.e. Corporate Failure Prediction: Some Empirical Evidence from Listed Firms in Ghana) using Altman's (2000) Z-Score

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts