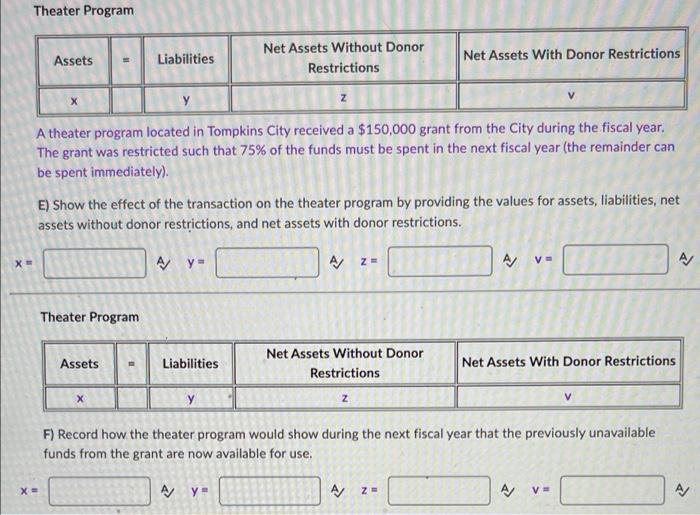

Question: Theater Program Assets Liabilities Net Assets Without Donor Restrictions Net Assets With Donor Restrictions X A theater program located in Tompkins City received a $150,000

Theater Program Assets Liabilities Net Assets Without Donor Restrictions Net Assets With Donor Restrictions X A theater program located in Tompkins City received a $150,000 grant from the City during the fiscal year. The grant was restricted such that 75% of the funds must be spent in the next fiscal year (the remainder can be spent immediately). E) Show the effect of the transaction on the theater program by providing the values for assets, liabilities, net assets without donor restrictions, and net assets with donor restrictions. Ay- AM Z V AM M Theater Program Assets Liabilities Net Assets Without Donor Restrictions Net Assets With Donor Restrictions Z F) Record how the theater program would show during the next fiscal year that the previously unavailable funds from the grant are now available for use. X- Ay AZ- A/ V. AJ Theater Program Assets Liabilities Net Assets Without Donor Restrictions Net Assets With Donor Restrictions X A theater program located in Tompkins City received a $150,000 grant from the City during the fiscal year. The grant was restricted such that 75% of the funds must be spent in the next fiscal year (the remainder can be spent immediately). E) Show the effect of the transaction on the theater program by providing the values for assets, liabilities, net assets without donor restrictions, and net assets with donor restrictions. Ay- AM Z V AM M Theater Program Assets Liabilities Net Assets Without Donor Restrictions Net Assets With Donor Restrictions Z F) Record how the theater program would show during the next fiscal year that the previously unavailable funds from the grant are now available for use. X- Ay AZ- A/ V. AJ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts