Question: Theodore E . Lariat is a single taxpayer born on September 2 2 , 1 9 7 5 . He was appointed the new coach

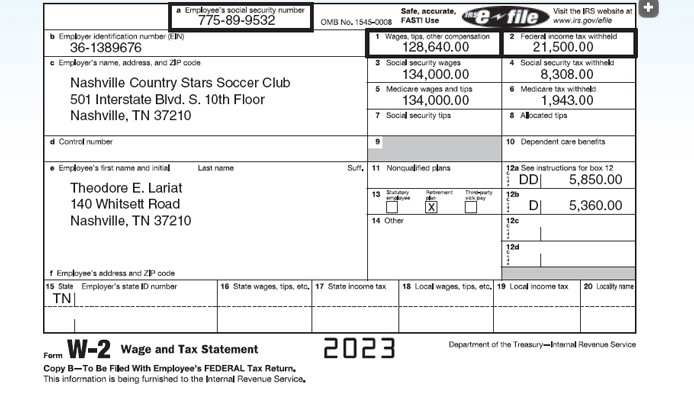

Theodore E Lariat is a single taxpayer born on September He was appointed the new coach of the Nashville Country Stars soccer team in January His address, Social Security number and wages are reported on his Form W: Fom W Wage and tax Statement

Department of the TreasuryIntemal Revenue Service

Copy BTo Be Filed With Employee's FEDERAL Tax Returns

This information is being furnished to the Internal Revenue Service. Theodore was previously the coach at a different soccer club in a different state. He sold his

previous home before moving to Nashville see S below His only selling expense was

sales commissions of $ His basis in the home was $ Theodore purchased his

previous home on January and sold it on January Obviously, he would not have

sold the home if it were not for the new job. He is currently renting the home he lives in Theodore was welcomed back to the Nashville area as he was formerly a star player on the

Country Stars team. During his playing time he had purchased a modest home in Nashville but

did not sell it instead choosing to rent the home over the years. His rental home is located at

Bransford Ave., Nashville, TN and was rented all year to his tenant. The tenant

occupied the home on January and pays rent of $ per month for each month of

the lease is a twoyear lease; however, Theodore required first and last months' rent

and a security deposit of $ and all were paid on January Theodore's rental

expenses for the year are:

Now that Theodore is back in Nashville, he actively manages the rental home. He probably

spends about ten hours per month on the rental. Theodore received the following B from his broker:

Combined Forms

This is important tax information and is being furnished to the IRS except as indicated If you are required to file a return, a negligence penalty or

other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported.

Copy B For Recipient

OMB No

Richman Investments

Wall Street, Floor

New York, NY tabletableBox : Gross Proceeds Box : Not checkedBox Security Quantity soldBox : Basis reported to IRS,Box : Type of Gain or Loss: Short TermtableBox Securitydescription CUSIPQuantity sold,tableBox b DateacquiredtableBox c Date soldor disposedtableBox dProceedstableBox e Cost orother basistableBox g Washsale lossdisallowedtableGainLossamountTart Corp,SamO Inc,Box : Gross Proceeds Box : Not checked,Box : Basis reported to IRS,Box : Type of Gain or Loss: Long TermtableBox Securitydescription CUSIPQuantity sold,tableBox b DateacquiredtableBox ic Date soldor disposedtableBox dProceedstableBox e Cost orother basistableBox g Washsale lossdisallowedtableGainLossamountBeard Corp,Form INT Interest IncomeBox Interest income,Box Early withdrawal penalty Box Interest on US Savings Bonds and Treasury obligationsBox Federal income tax withheld,Box Investment expenses,Box Foreign Tax PaidBox Foreign country or US possession Box Taxexempt interest,Box Specified private activity bond interestBox Market Discount,Box Bond Premium,Box Bond premium on Treasury obligations,Box Bond premium on taxexempt bond Required: Complete Theodores federal tax return for Determine if Form and Schedule D are required. If so use those forms and Form Schedule E page only and Form page only to complete this tax return. Do not complete Form for reporting depreciation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock