Question: Theodore E. Lariat is a single taxpayer born on September 22, 1974. He was appointed the new coach of the Nashville Country Stars soccer

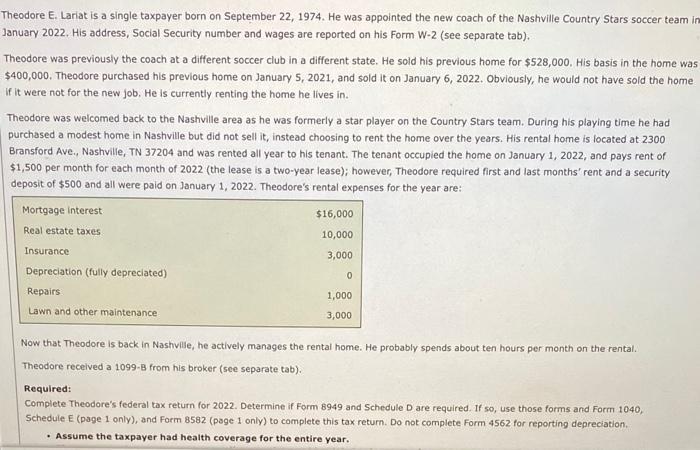

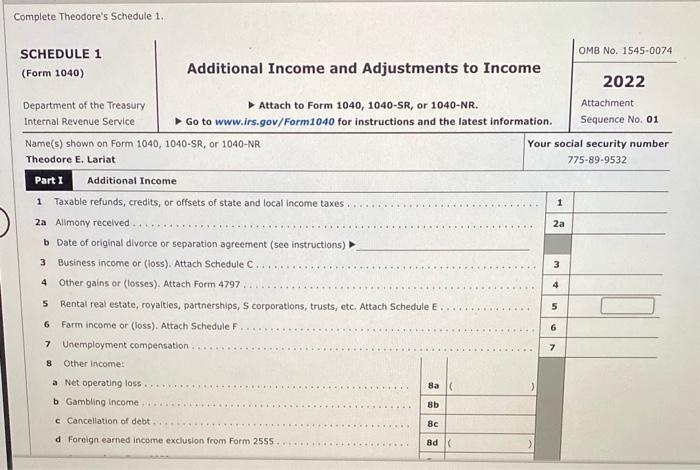

Theodore E. Lariat is a single taxpayer born on September 22, 1974. He was appointed the new coach of the Nashville Country Stars soccer team in January 2022. His address, Social Security number and wages are reported on his Form W-2 (see separate tab). Theodore was previously the coach at a different soccer club in a different state. He sold his previous home for $528,000. His basis in the home was $400,000. Theodore purchased his previous home on January 5, 2021, and sold it on January 6, 2022. Obviously, he would not have sold the home if it were not for the new job. He is currently renting the home he lives in. Theodore was welcomed back to the Nashville area as he was formerly a star player on the Country Stars team. During his playing time he had purchased a modest home in Nashville but did not sell it, instead choosing to rent the home over the years. His rental home is located at 2300 Bransford Ave., Nashville, TN 37204 and was rented all year to his tenant. The tenant occupied the home on January 1, 2022, and pays rent of $1,500 per month for each month of 2022 (the lease is a two-year lease); however, Theodore required first and last months' rent and a security deposit of $500 and all were paid on January 1, 2022. Theodore's rental expenses for the year are: Mortgage interest Real ate taxes Insurance Depreciation (fully depreciated) Repairs Lawn and other maintenance $16,000 10,000 3,000 0 1,000 3,000 Now that Theodore is back in Nashville, he actively manages the rental home. He probably spends about ten hours per month on the rental. Theodore received a 1099-B from his broker (see separate tab). Required: Complete Theodore's federal tax return for 2022. Determine if Form 8949 and Schedule D are required. If so, use those forms and Form 1040, Schedule E (page 1 only), and Form 8582 (page 1 only) to complete this tax return. Do not complete Form 4562 for reporting depreciation. Assume the taxpayer had health coverage for the entire year. Complete Theodore's Schedule 1. SCHEDULE 1 (Form 1040) Department of the Treasury Internal Revenue Service 5 Additional Income and Adjustments to Income Name(s) shown on Form 1040, 1040-SR, or 1040-NR Theodore E. Lariat Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony received. b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule C... 4 Other gains or (losses). Attach Form 4797 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E Farm income or (loss). Attach Schedule F 7 Unemployment compensation 8 6 Attach to Form 1040, 1040-SR, or 1040-NR. Attachment Go to www.irs.gov/Form1040 for instructions and the latest information. Sequence No. 01 Other Income: a Net operating loss b Gambling income. c Cancellation of debt. d Foreign earned income exclusion from Form 2555 8a ( 8b 8c 8d ( 1 Your social security number 775-89-9532 2a 3 4 5 OMB No. 1545-0074 6 2022 7 Part I A Did you make any payments in 2022 that would require you to file Form(s) 1099? (see instructions) B If "Yes," did you or will you file required Forms 10997 1a Physical address of each property (street, city, state, ZIP code) A 2300 Bransford Avenue, Nashville, TN 37204 B C 1b A B Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use Schedule C (see instructions). If you are an individual, report farm rental income or loss from Form 4835 on page 2, line 40. Type of Property 2 For each rental real estate property (from list below) listed above, report the number of fair 2 X rental and personal use days. Check the QJV box only if you meet the requirements to file as a qualified joint venture. See Instructions. Type of Property: 1 Single Family Residence 2 Multi-Family Residence 3 Income: 4 Rents received Royalties received. Expenses: 5 Advertising 3 Vacation/Short-Term Rental 4 Commercial Properties: 3 5 Land 6 Royalties 4 A 5 B Fair Rental Days Personal Use Days 7 Self-Rental 8 Other (describe) A 8 Yes Yes QJV 0 D No No

Step by Step Solution

3.37 Rating (141 Votes )

There are 3 Steps involved in it

Form 1040 Schedule 1 Name Theodore E Lariat Social Security Number 775899532 Part I Additional Income Line Description Amount 5 Rental real estate royalties partnerships S corporations trusts etc Atta... View full answer

Get step-by-step solutions from verified subject matter experts