Question: Theoretical Questions (10 marks * 2 = 20 marks) 1. Briefly explain the determinants of interest rate risk premium of a loan or security. Sunshine

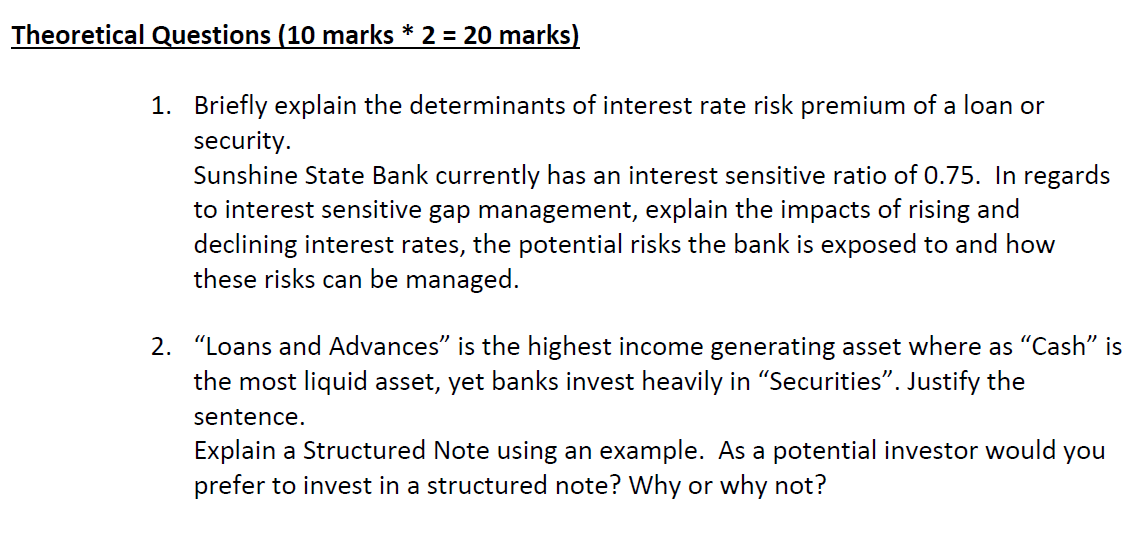

Theoretical Questions (10 marks * 2 = 20 marks) 1. Briefly explain the determinants of interest rate risk premium of a loan or security. Sunshine State Bank currently has an interest sensitive ratio of 0.75. In regards to interest sensitive gap management, explain the impacts of rising and declining interest rates, the potential risks the bank is exposed to and how these risks can be managed. 2. Loans and Advances is the highest income generating asset where as "Cash is the most liquid asset, yet banks invest heavily in Securities. Justify the sentence. Explain a Structured Note using an example. As a potential investor would you prefer to invest in a structured note? Why or why not? Theoretical Questions (10 marks * 2 = 20 marks) 1. Briefly explain the determinants of interest rate risk premium of a loan or security. Sunshine State Bank currently has an interest sensitive ratio of 0.75. In regards to interest sensitive gap management, explain the impacts of rising and declining interest rates, the potential risks the bank is exposed to and how these risks can be managed. 2. Loans and Advances is the highest income generating asset where as "Cash is the most liquid asset, yet banks invest heavily in Securities. Justify the sentence. Explain a Structured Note using an example. As a potential investor would you prefer to invest in a structured note? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts