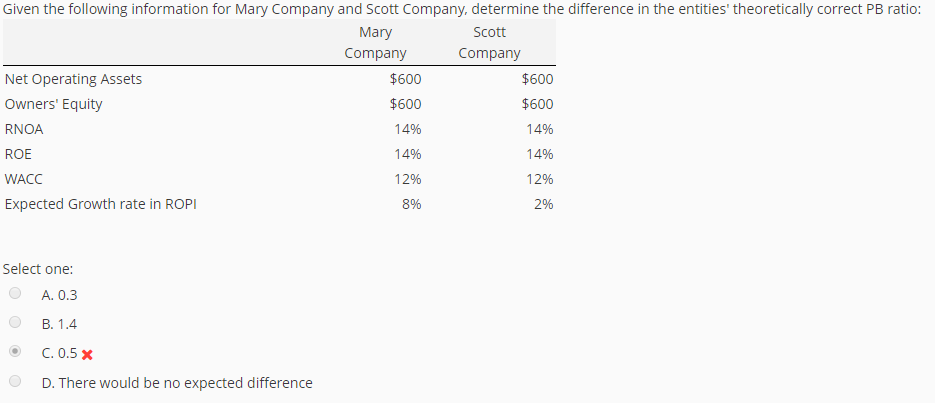

Question: Theoretically correct PB ratio - Please show your work how this is calculated. Given the following information for Mary Company and Scott Company, determine the

Theoretically correct PB ratio - Please show your work how this is calculated.

Given the following information for Mary Company and Scott Company, determine the difference in the entities' theoretically correct PB ratio Mary Company Scott Company Net Operating Assets Owners' Equity RNOA ROE WACC Expected Growth rate in ROPI $600 $600 14% 14% 12% 8% $600 $600 14% 14% 12% 2% Select one: A. 0.3 B. 1.4 C.0.5 x D. There would be no expected difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts