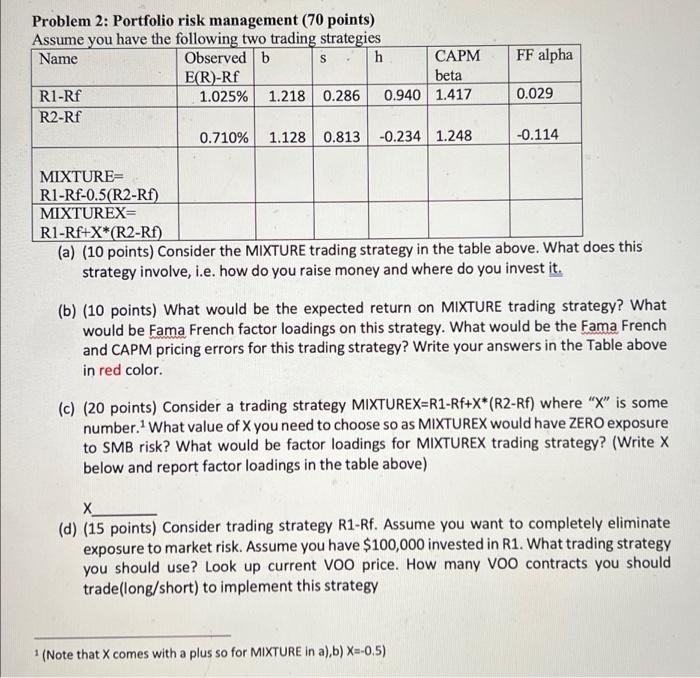

Question: There are 5 parts. ABCDE. please help!! FF alpha Problem 2: Portfolio risk management (70 points) Assume you have the following two trading strategies Name

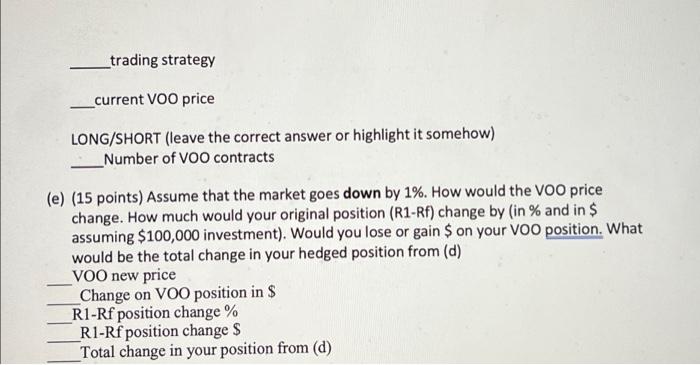

FF alpha Problem 2: Portfolio risk management (70 points) Assume you have the following two trading strategies Name Observed Sh CAPM E(R)-Rf beta R1-Rf 1.025% 1.218 0.286 0.940 1.417 R2-Rf 0.710% 1.1280.813 -0.234 1.248 0.029 -0.114 MIXTURE= R1-Rf-0.5(R2-Rf) MIXTUREX R1-Rf+X*(R2-Rf) (a) (10 points) Consider the MIXTURE trading strategy in the table above. What does this strategy involve, i.e. how do you raise money and where do you invest it. (b) (10 points) What would be the expected return on MIXTURE trading strategy? What would be Fama French factor loadings on this strategy. What would be the Fama French and CAPM pricing errors for this trading strategy? Write your answers in the Table above in red color. (c) (20 points) Consider a trading strategy MIXTUREX=R1-RF+X*(R2-Rf) where "X" is some number. What value of X you need to choose so as MIXTUREX would have ZERO exposure to SMB risk? What would be factor loadings for MIXTUREX trading strategy? (Write X below and report factor loadings in the table above) (d) (15 points) Consider trading strategy R1-Rf. Assume you want to completely eliminate exposure to market risk. Assume you have $100,000 invested in R1. What trading strategy you should use? Look up current voo price. How many Voo contracts you should trade(long/short) to implement this strategy 1 (Note that comes with a plus so for MIXTURE in a),b) X=-0.5) _trading strategy _current VOO price LONG/SHORT (leave the correct answer or highlight it somehow) Number of VOO contracts (e) (15 points) Assume that the market goes down by 1%. How would the VOO price change. How much would your original position (R1-Rf) change by (in % and in $ assuming $100,000 investment). Would you lose or gain $ on your VOO position. What would be the total change in your hedged position from (d) VOO new price Change on VOO position in $ R1-Rf position change % R1-Rf position change $ Total change in your position from (d) FF alpha Problem 2: Portfolio risk management (70 points) Assume you have the following two trading strategies Name Observed Sh CAPM E(R)-Rf beta R1-Rf 1.025% 1.218 0.286 0.940 1.417 R2-Rf 0.710% 1.1280.813 -0.234 1.248 0.029 -0.114 MIXTURE= R1-Rf-0.5(R2-Rf) MIXTUREX R1-Rf+X*(R2-Rf) (a) (10 points) Consider the MIXTURE trading strategy in the table above. What does this strategy involve, i.e. how do you raise money and where do you invest it. (b) (10 points) What would be the expected return on MIXTURE trading strategy? What would be Fama French factor loadings on this strategy. What would be the Fama French and CAPM pricing errors for this trading strategy? Write your answers in the Table above in red color. (c) (20 points) Consider a trading strategy MIXTUREX=R1-RF+X*(R2-Rf) where "X" is some number. What value of X you need to choose so as MIXTUREX would have ZERO exposure to SMB risk? What would be factor loadings for MIXTUREX trading strategy? (Write X below and report factor loadings in the table above) (d) (15 points) Consider trading strategy R1-Rf. Assume you want to completely eliminate exposure to market risk. Assume you have $100,000 invested in R1. What trading strategy you should use? Look up current voo price. How many Voo contracts you should trade(long/short) to implement this strategy 1 (Note that comes with a plus so for MIXTURE in a),b) X=-0.5) _trading strategy _current VOO price LONG/SHORT (leave the correct answer or highlight it somehow) Number of VOO contracts (e) (15 points) Assume that the market goes down by 1%. How would the VOO price change. How much would your original position (R1-Rf) change by (in % and in $ assuming $100,000 investment). Would you lose or gain $ on your VOO position. What would be the total change in your hedged position from (d) VOO new price Change on VOO position in $ R1-Rf position change % R1-Rf position change $ Total change in your position from (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts