Question: There are five notes and one bond. Theoretical (not based on actual rates) ontherun Treasury yields for a 2/15/22 settlement date are given with the

There are five notes and one bond. Theoretical (not based on actual rates) on‐the‐run Treasury yields for a 2/15/22 settlement date are given with the maturities. Assume each security is priced at par.

| Note/Bond | Maturity | Yield/Coupon |

| 2 - Year Note | 2/15/2024 | 1.25% |

| 3 - Year Note | 2/15/2054 | 1.75% |

| 5 - Year Note | 2/15/2027 | 2.25% |

| 7 - Year Note | 2/15/2029 | 3.00% |

| 10 - Year Note | 2/15/2032 | 3.40% |

| 30 - Year Bond | 2/15/2052 | 4.20% |

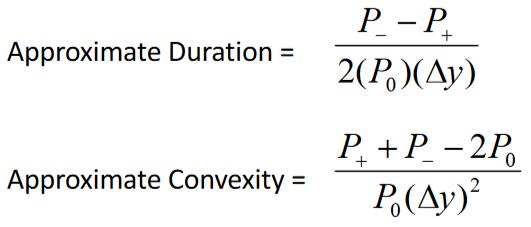

- Calculate the modified duration and convexity measure in years using the below formulas. Use 10 basis points (0.10%) as the plus and minus change in yield.

Approximate Duration = Approximate Convexity = P-P 2(P)(Ay) P+P-2P P.(Ay)

Step by Step Solution

3.56 Rating (142 Votes )

There are 3 Steps involved in it

Sure I can help you wi... View full answer

Get step-by-step solutions from verified subject matter experts