Question: There are five sets that are required. Help Save& Exit Sub Check my work Complete the below table to calculate the price of a $1.4

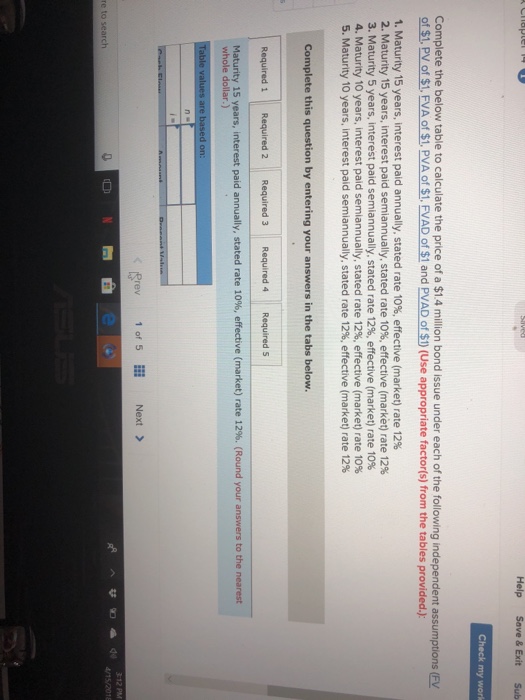

Help Save& Exit Sub Check my work Complete the below table to calculate the price of a $1.4 million bond issue under each of the following independent assumptions (FV of 1" PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVADorsi) (Use appropriate factor(s) from the tables provided.): 1. Maturity 15 years, interest paid annually, stated rate 10%, effective (market) rate 12% 2. Maturity 15 years, interest paid semiannually, stated rate 10%, effective (market) rate 12% 3. Maturity 5 years, interest paid semiannually, stated rate 12%, effective (market) rate 10% 4. Maturity 10 years, interest paid semiannually, stated rate 12%, effective (market) rate 10% 5, Maturity 10 years, interest paid semiannually, stated rate 12%, effective (market) rate 12% Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required S Maturity 15 years, interest paid annually, stated rate 10%, effective (market) rate 12%. (Round your answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts