Question: There are four basic inventory methods to account for items. They are: First In First Out FIFO, Last In First Out LIFO, Average Cost,

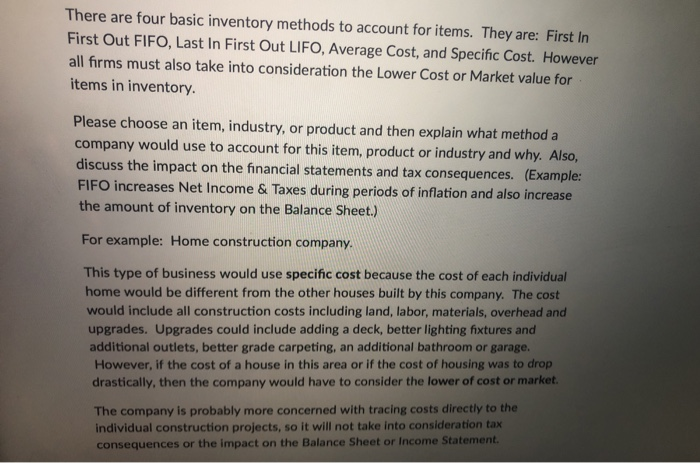

There are four basic inventory methods to account for items. They are: First In First Out FIFO, Last In First Out LIFO, Average Cost, and Specific Cost. However all firms must also take into consideration the Lower Cost or Market value for items in inventory. Please choose an item, industry, or product and then explain what method a company would use to account for this item, product or industry and why. Also, discuss the impact on the financial statements and tax consequences. (Example: FIFO increases Net Income & Taxes during periods of inflation and also increase the amount of inventory on the Balance Sheet.) For example: Home construction company. This type of business would use specific cost because the cost of each individual home would be different from the other houses built by this company. The cost would include all construction costs including land, labor, materials, overhead and upgrades. Upgrades could include adding a deck, better lighting fixtures and additional outlets, better grade carpeting, an additional bathroom or garage. However, if the cost of a house in this area or if the cost of housing was to drop drastically, then the company would have to consider the lower of cost or market. The company is probably more concerned with tracing costs directly to the individual construction projects, so it will not take into consideration tax consequences or the impact on the Balance Sheet or Income Statement.

Step by Step Solution

3.55 Rating (148 Votes )

There are 3 Steps involved in it

Our experts were un... View full answer

Get step-by-step solutions from verified subject matter experts