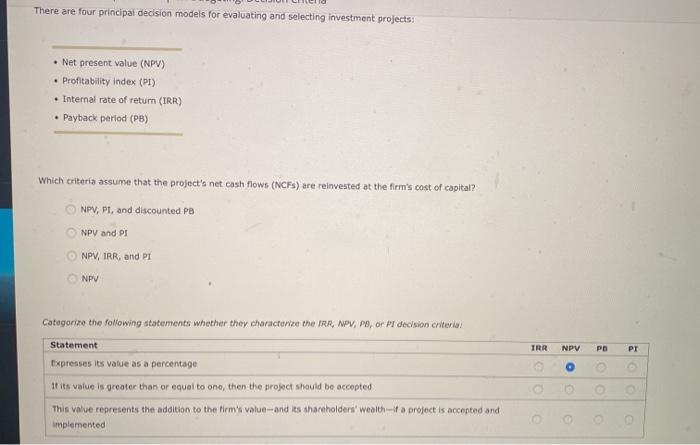

Question: There are four principal decision models for evaluating and selecting investment projects: Net present value (NPV) Profitability index (PI) Internal rate of retum (IRR) Payback

There are four principal decision models for evaluating and selecting investment projects: Net present value (NPV) Profitability index (PI) Internal rate of retum (IRR) Payback period (PB) Which criteria assume that the project's net cash flows (NCFs) are reinvested at the firm's cost of capital? NPV, PL, and discounted PB NPV and PI NPV, IRR, and PI NPV Categorize the following statements whether they characterize the IRR MPV, PD, or PI decision criteria IRR NPV PO PI Statement Expresses its value as a percentage If its value is greater than or equal to one, then the project should be accepted o This value represents the addition to the firm's value-and its shareholders' wealth-if a project is accepted and implemented

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts