Question: There are four principal decision models for evaluating and selecting investment projects: Net present value (NPV) Profitability index (PI) Internal rate of return (IRR) Payback

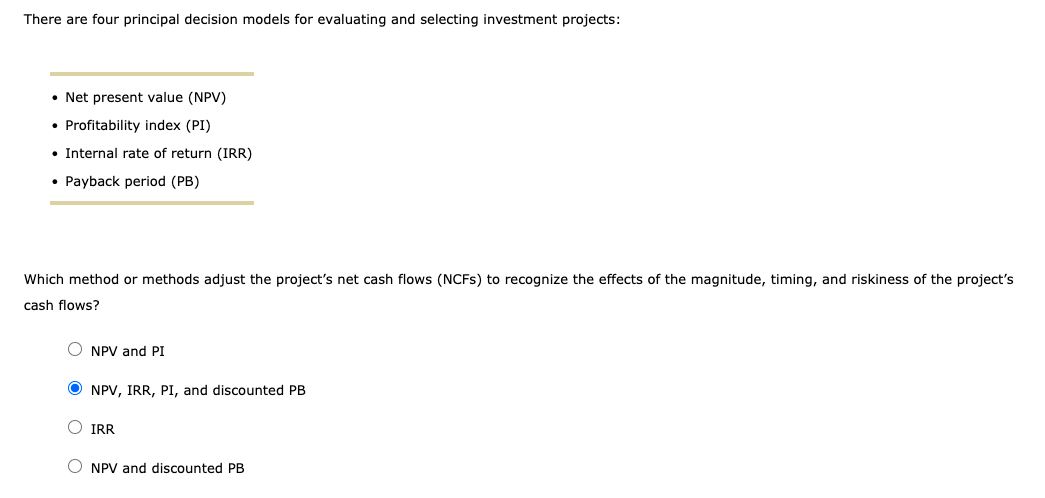

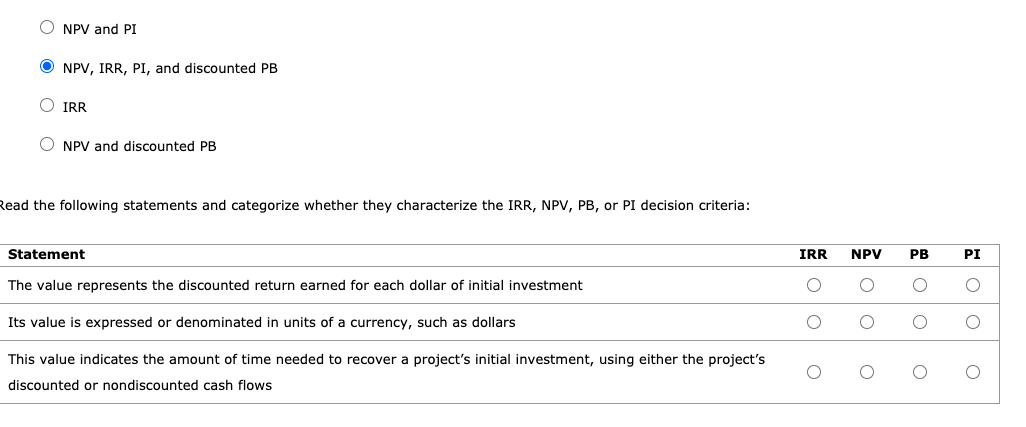

There are four principal decision models for evaluating and selecting investment projects: Net present value (NPV) Profitability index (PI) Internal rate of return (IRR) Payback period (PB) Which method or methods adjust the project's net cash flows (NCFS) to recognize the effects of the magnitude, timing, and riskiness of the project's cash flows? O NPV and PI O NPV, IRR, PI, and discounted PB O IRR O NPV and discounted PB O NPV and PI NPV, IRR, PI, and discounted PB O IRR O NPV and discounted PB Read the following statements and categorize whether they characterize the IRR, NPV, PB, or PI decision criteria: Statement IRR NPV PB PI The value represents the discounted return earned for each dollar of initial investment O o o oo O O Its value is expressed or denominated in units of a currency, such as dollars O This value indicates the amount of time needed to recover a project's initial investment, using either the project's discounted or nondiscounted cash flows O O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts