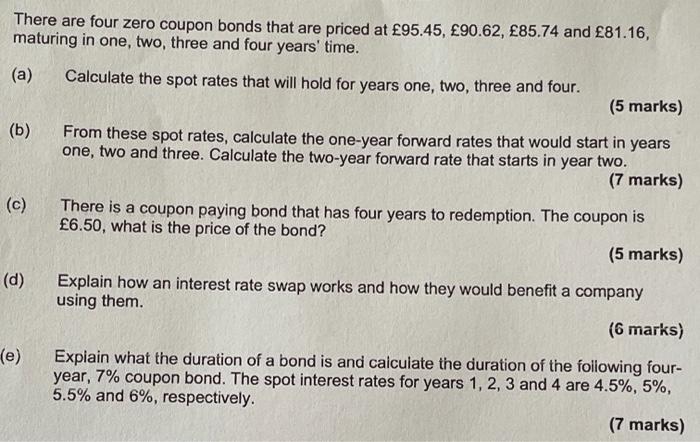

Question: there are four zero coupon bonds There are four zero coupon bonds that are priced at 95.45, 90.62, 85.74 and 81.16, maturing in one, two,

There are four zero coupon bonds that are priced at 95.45, 90.62, 85.74 and 81.16, maturing in one, two, three and four years' time. (a) Calculate the spot rates that will hold for years one, two, three and four. (5 marks) (b) From these spot rates, calculate the one-year forward rates that would start in years one, two and three. Calculate the two-year forward rate that starts in year two. (7 marks) There is a coupon paying bond that has four years to redemption. The coupon is 6.50, what is the price of the bond? (5 marks) (d) Explain how an interest rate swap works and how they would benefit a company using them. (6 marks) (e) Explain what the duration of a bond is and calculate the duration of the following four- year, 7% coupon bond. The spot interest rates for years 1, 2, 3 and 4 are 4.5%, 5%, 5.5% and 6%, respectively. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts