Question: There are three parts for this question a. Explain why trading futures is very risky. You can center your discussion on leverage and margin.

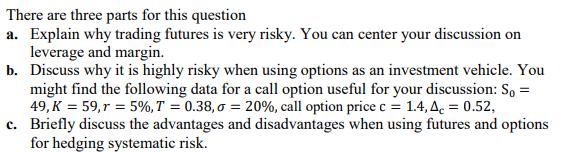

There are three parts for this question a. Explain why trading futures is very risky. You can center your discussion on leverage and margin. b. Discuss why it is highly risky when using options as an investment vehicle. You might find the following data for a call option useful for your discussion: S = 49, K = 59, r = 5%, T = 0.38, o = 20%, call option price c = 1.4, 4c = 0.52, c. Briefly discuss the advantages and disadvantages when using futures and options for hedging systematic risk.

Step by Step Solution

There are 3 Steps involved in it

a Trading futures is very risky primarily due to the high leverage and margin involved Leverage allows a trader to control a large contract size with a relatively small deposit or margin However this ... View full answer

Get step-by-step solutions from verified subject matter experts