Question: There are three parts in this question. Please answer all of them. Suppose you are managing a $100 million Australian government bond portfolio. You believe

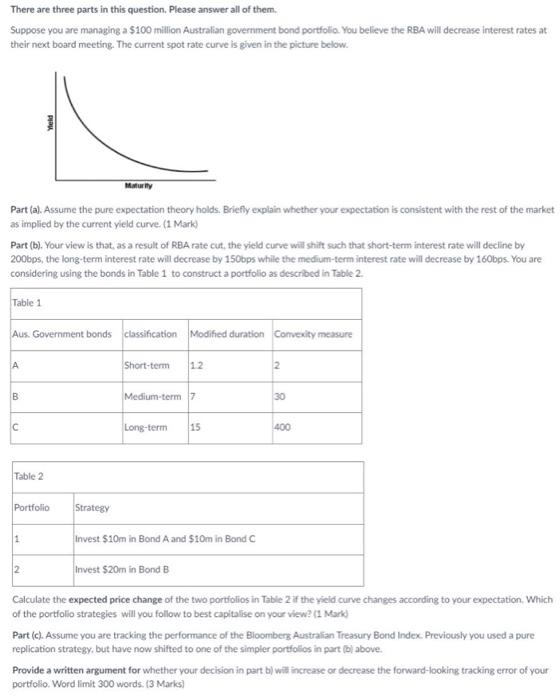

There are three parts in this question. Please answer all of them. Suppose you are managing a $100 million Australian government bond portfolio. You believe the RBA will decrease interest rates at their next board meeting. The current spot rate curve is given in the picture below. Yield Maturity Part (a). Assume the pure expectation theory holds. Briefly explain whether your expectation is consistent with the rest of the market as implied by the current yield curve. (1 Mark Part (b). Your view is that, as a result of RBA rate cut, the yield curve will shit such that short-term interest rate will decline by 200bps, the long-term interest rate will decrease by 150bps while the medium-term interest rate will decrease by 160bps. You are considering using the bonds in Table 1 to construct a portfolio as described in Table 2. Table 1 Aus Government bonds classification Modified duration Convexity measure Short-term 12 2 B Medium-term 7 30 Ic Long-term 15 400 Table 2 Portfolio Strategy 1 Invest $10m in Bond A and $10m in Bond 2 Invest $20m in Bond B Calculate the expected price change of the two portfolios in Table 2 the yield curve changes according to your expectation. Which of the portfolio strategies will you follow to best capitalise on your view? (1 Mark Part (c). Assume you are tracking the performance of the Bloomberg Australian Treasury Bond Index. Previously you used a pure replication strategy, but have now shifted to one of the simpler portfolios in part bl above. Provide a written argument for whether your decision in part b) will increase or decrease the forward-looking tracking error of your portiollo Word limit 300 words. (3 Marks) There are three parts in this question. Please answer all of them. Suppose you are managing a $100 million Australian government bond portfolio. You believe the RBA will decrease interest rates at their next board meeting. The current spot rate curve is given in the picture below. Yield Maturity Part (a). Assume the pure expectation theory holds. Briefly explain whether your expectation is consistent with the rest of the market as implied by the current yield curve. (1 Mark Part (b). Your view is that, as a result of RBA rate cut, the yield curve will shit such that short-term interest rate will decline by 200bps, the long-term interest rate will decrease by 150bps while the medium-term interest rate will decrease by 160bps. You are considering using the bonds in Table 1 to construct a portfolio as described in Table 2. Table 1 Aus Government bonds classification Modified duration Convexity measure Short-term 12 2 B Medium-term 7 30 Ic Long-term 15 400 Table 2 Portfolio Strategy 1 Invest $10m in Bond A and $10m in Bond 2 Invest $20m in Bond B Calculate the expected price change of the two portfolios in Table 2 the yield curve changes according to your expectation. Which of the portfolio strategies will you follow to best capitalise on your view? (1 Mark Part (c). Assume you are tracking the performance of the Bloomberg Australian Treasury Bond Index. Previously you used a pure replication strategy, but have now shifted to one of the simpler portfolios in part bl above. Provide a written argument for whether your decision in part b) will increase or decrease the forward-looking tracking error of your portiollo Word limit 300 words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts