Question: There are two dates, Date 0 and Date 1. There are two assets, Asset 1 and Asset 2. Let S denote the price of

![2. Write down the Date-1 payoff of the long position swap in terms of S, S, and f. [5 marks]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/04/6440b45a6b7ff_1681962075652.jpg)

![3. Write down a replicating portfolio for the long swap. [5 marks]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/04/6440b46708907_1681962088255.jpg)

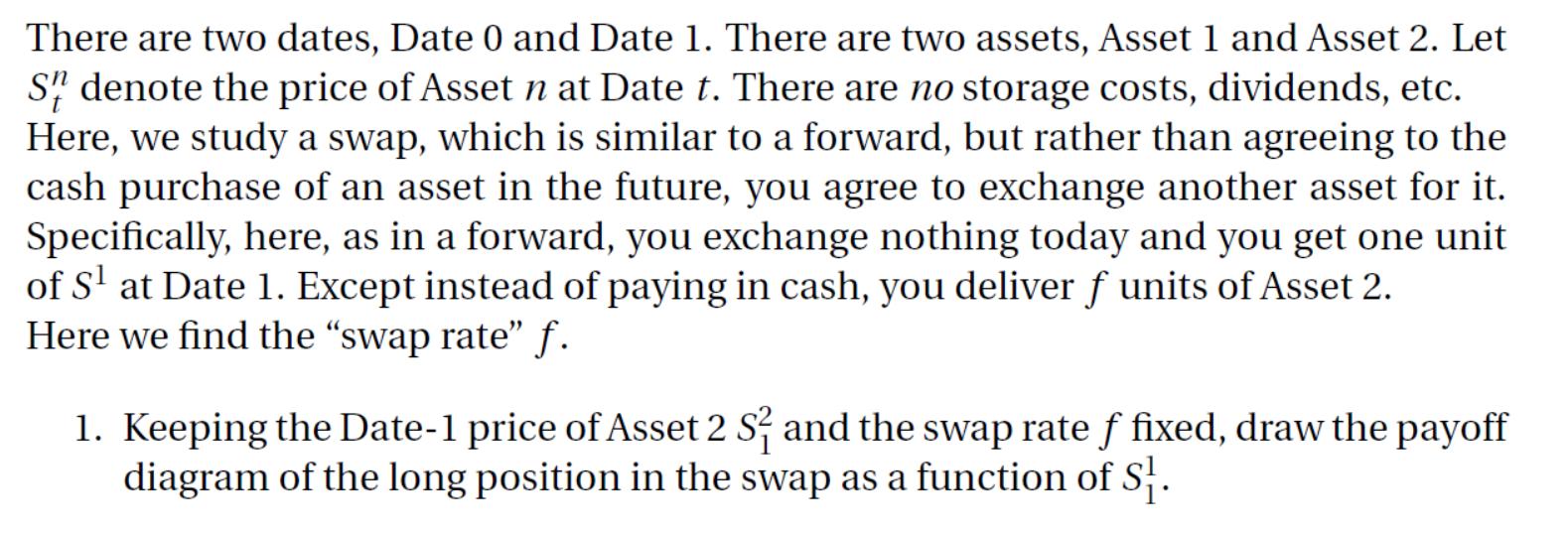

There are two dates, Date 0 and Date 1. There are two assets, Asset 1 and Asset 2. Let S denote the price of Asset n at Date t. There are no storage costs, dividends, etc. Here, we study a swap, which is similar to a forward, but rather than agreeing to the cash purchase of an asset in the future, you agree to exchange another asset for it. Specifically, here, as in a forward, you exchange nothing today and you get one unit of S at Date 1. Except instead of paying in cash, you deliver f units of Asset 2. Here we find the "swap rate" f. 1. Keeping the Date-1 price of Asset 2 S and the swap rate f fixed, draw the payoff diagram of the long position in the swap as a function of S 2. Write down the Date-1 payoff of the long position swap in terms of S, S, and f. [5 marks] 3. Write down a replicating portfolio for the long swap. [5 marks]

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts