Question: There are two projects under consideration by the Rainbow Factory. Each of the projects will require an initial investment of $35,000 and is expected to

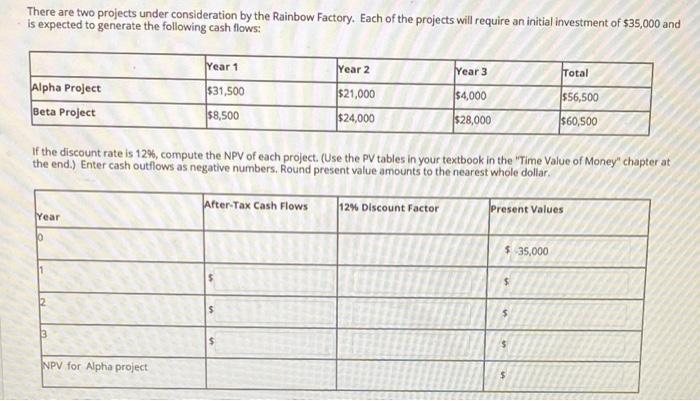

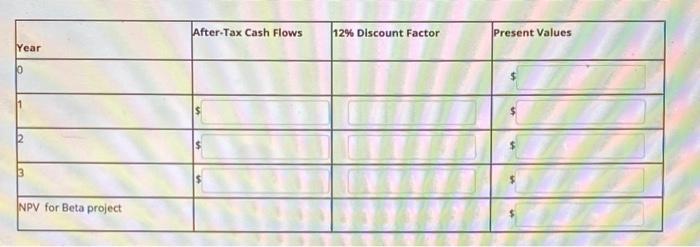

There are two projects under consideration by the Rainbow Factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: Year 2 Year 3 Year 1 $31,500 Total Alpha Project Beta Project 556,500 $21,000 $24,000 $8,500 $4,000 $28,000 $60,500 If the discount rate is 12%, compute the NPV of each project. (Use the PV tables in your textbook in the "Time Value of Money" chapter at the end.) Enter cash outflows as negative numbers. Round present value amounts to the nearest whole dollar After-Tax Cash Flows 12% Discount Factor Present Values Year $ 35,000 5 5 $ NPV for Alpha project $ After Tax Cash Flows 12% Discount Factor Present Values Year 10 3 NPV for Beta project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts