Question: THERE ARE TWO QUESTIONS INCLUDED AFTER THE DATA . . . make sure to answer both. Pivot, LLC manufactures sofas specially designed to be easy

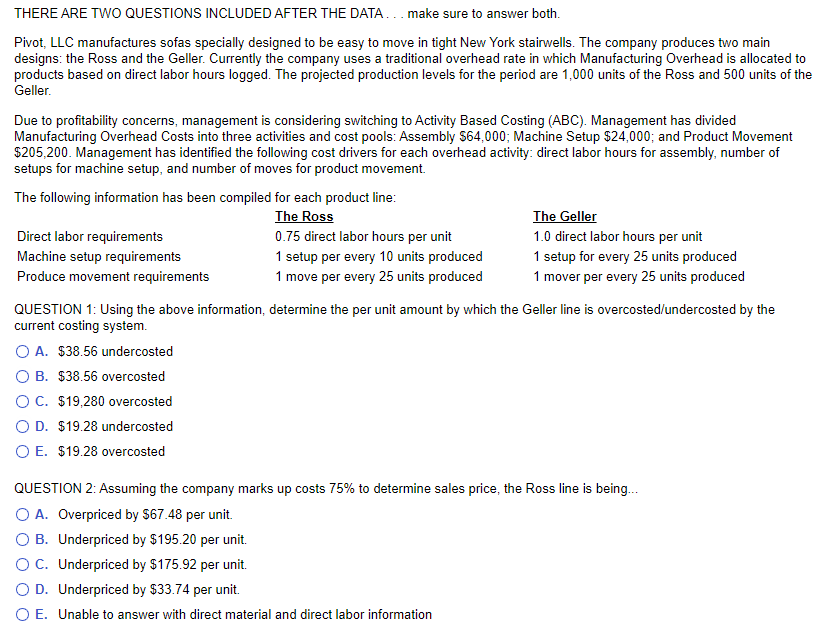

THERE ARE TWO QUESTIONS INCLUDED AFTER THE DATA . . . make sure to answer both. Pivot, LLC manufactures sofas specially designed to be easy to move in tight New York stairwells. The company produces two main designs: the Ross and the Geller. Currently the company uses a traditional overhead rate in which Manufacturing Overhead is allocated to products based on direct labor hours logged. The projected production levels for the period are 1,000 units of the Ross and 500 units of the Geller. Due to profitability concerns, management is considering switching to Activity Based Costing (ABC). Management has divided Manufacturing Overhead Costs into three activities and cost pools: Assembly $64,000; Machine Setup $24,000; and Product Movement $205,200. Management has identified the following cost drivers for each overhead activity: direct labor hours for assembly, number of setups for machine setup, and number of moves for product movement. QUESTION 1: Using the above information, determine the per unit amount by which the Geller line is overcosted/undercosted by the current costing system. A. $38.56 undercosted B. $38.56 overcosted C. $19,280 overcosted D. $19.28 undercosted E. $19.28 overcosted QUESTION 2: Assuming the company marks up costs 75% to determine sales price, the Ross line is being... A. Overpriced by $67.48 per unit. B. Underpriced by $195.20 per unit. C. Underpriced by $175.92 per unit. D. Underpriced by $33.74 per unit. E. Unable to answer with direct material and direct labor information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts