Question: There are two questions please. (3 screenshots) The first screen shot is to be used to solve the question ( Locate the treasury bond.........) ib

There are two questions please. (3 screenshots)

The first screen shot is to be used to solve the question ( Locate the treasury bond.........) ib the second screen shot

The other question is the screen shot (Laurel inc and hardy Corporation.

I don't know what else the expert wants.

Chegg permits us to send question through screenshot

There is no way to upload the question in excel

Dear Expert,

Te question does not contain data in Excel

The question is on "CONNECT"

there is no intensive data supplied.That is all you need to solve the question please.

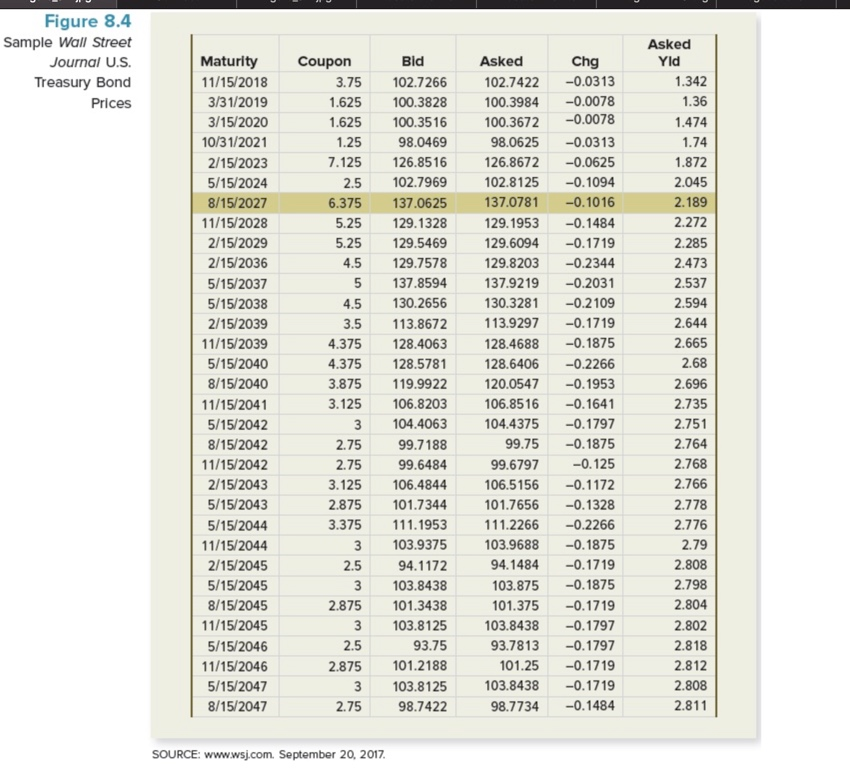

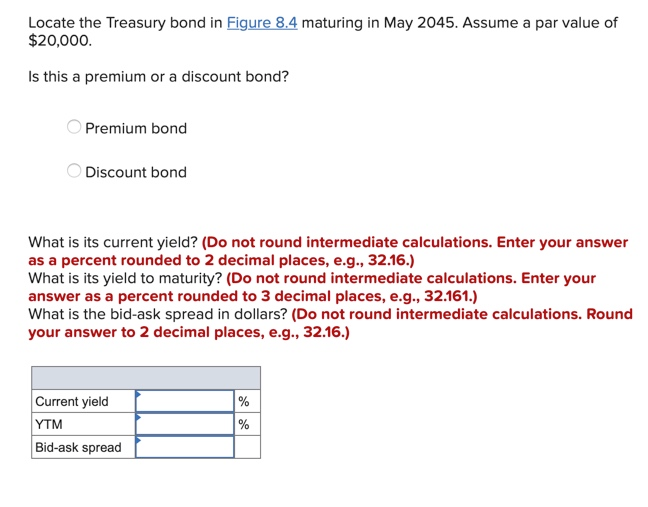

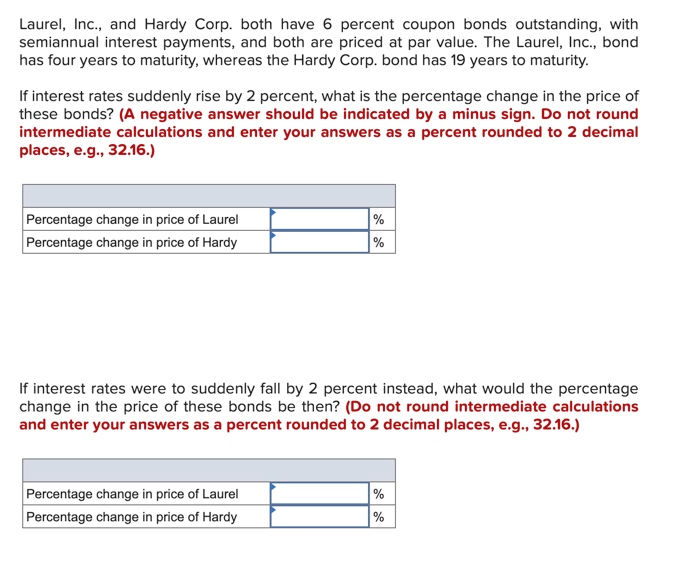

Figure 8.4 Sample Wall Street Journal U.S. Treasury Bond Prices Coupon 3.75 1.625 1.625 1.25 Maturity 11/15/2018 3/31/2019 3/15/2020 10/31/2021 2/15/2023 5/15/2024 8/15/2027 11/15/2028 2/15/2029 2/15/2036 5/15/2037 5/15/2038 2/15/2039 11/15/2039 5/15/2040 8/15/2040 11/15/2041 5/15/2042 8/15/2042 11/15/2042 2/15/2043 5/15/2043 5/15/2044 11/15/2044 2/15/2045 5/15/2045 8/15/2045 11/15/2045 5/15/2046 11/15/2046 5/15/2047 8/15/2047 7.125 2.5 6.375 5.25 5.25 4.5 5 4.5 3.5 4.375 4.375 3.875 3.125 3 2.75 2.75 3.125 2.875 3.375 3 2.5 3 2.875 3 Bld 102.7266 100.3828 100.3516 98.0469 126.8516 102.7969 137.0625 129.1328 129.5469 129.7578 137.8594 130.2656 113.8672 128.4063 128.5781 119.9922 106.8203 104.4063 99.7188 99.6484 106.4844 101.7344 111.1953 103.9375 94.1172 103.8438 101.3438 103.8125 93.75 101.2188 103.8125 98.7422 Asked 102.7422 100.3984 100.3672 98.0625 126.8672 102.8125 137.0781 129. 1953 129.6094 129.8203 137.9219 130.3281 113.9297 128.4688 128.6406 120.0547 106.8516 104.4375 99.75 99.6797 106.5156 101.7656 111.2266 103.9688 94.1484 103.875 101.375 103.8438 93.7813 101.25 103.8438 98.7734 Chg -0.0313 -0.0078 -0.0078 -0.0313 -0.0625 -0.1094 -0.1016 -0.1484 -0.1719 -0.2344 -0.2031 -0.2 109 -0.1719 -0.1875 -0.2266 -0.1953 -0.1641 -0.1797 -0.1875 -0.125 -0.1172 -0.1328 -0.2266 -0.1875 -0.1719 -0.1875 -0.1719 -0.1797 -0.1797 -0.1719 -0.1719 -0.1484 Asked Yld 1.342 1.36 1.474 1.74 1.872 2.045 2.189 2.272 2.285 2.473 2.537 2.594 2.644 2.665 2.68 2.696 2.735 2.751 2.764 2.768 2.766 2.778 2.776 2.79 2.808 2.798 2.804 2.802 2.818 2.812 2.808 2.811 2.5 2.875 3 2.75 SOURCE: www.wsj.com. September 20, 2017. Locate the Treasury bond in Figure 8.4 maturing in May 2045. Assume a par value of $20,000. Is this a premium or a discount bond? Premium bond Discount bond What is its current yield? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) What is its yield to maturity? (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) What is the bid-ask spread in dollars? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) Current yield YTM Bid-ask spread % % Laurel, Inc., and Hardy Corp. both have 6 percent coupon bonds outstanding, with semiannual interest payments, and both are priced at par value. The Laurel, Inc., bond has four years to maturity, whereas the Hardy Corp. bond has 19 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) % Percentage change in price of Laurel Percentage change in price of Hardy % If interest rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of these bonds be then? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Percentage change in price of Laurel Percentage change in price of Hardy % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts