Question: There are two separate irrevocable Grantor trusts each with a grandchild listed as the beneficiary of the grantors, both of these trusts have 5 0

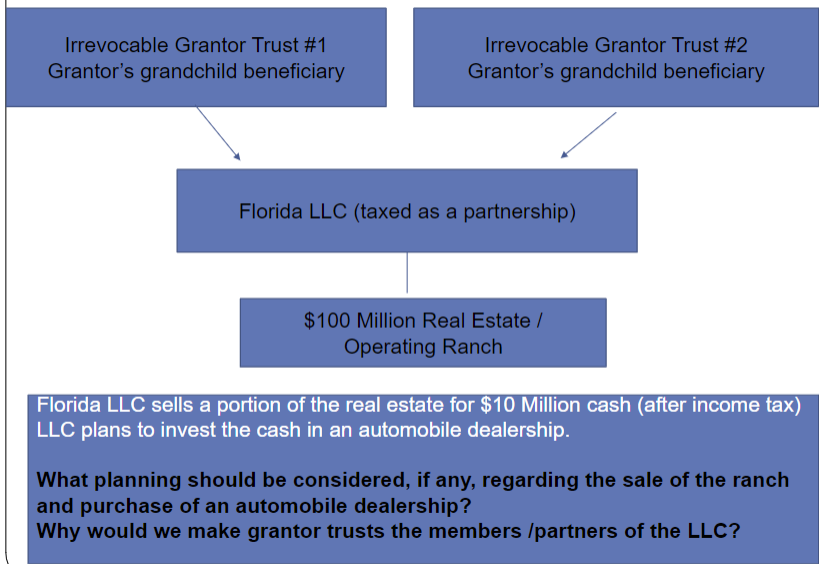

There are two separate irrevocable Grantor trusts each with a grandchild listed as the beneficiary of the grantors, both of these trusts have ownership of a Florida LLC which owns $ million in real estateoperating ranch Florida LLC sells a portion of the real estate for $ Million cash after income tax

LLC plans to invest the cash in an automobile dealership.

What planning should be considered, if any, regarding the sale of the ranch

and purchase of an automobile dealership?

Why would we make grantor trusts the members partners of the LLC

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock