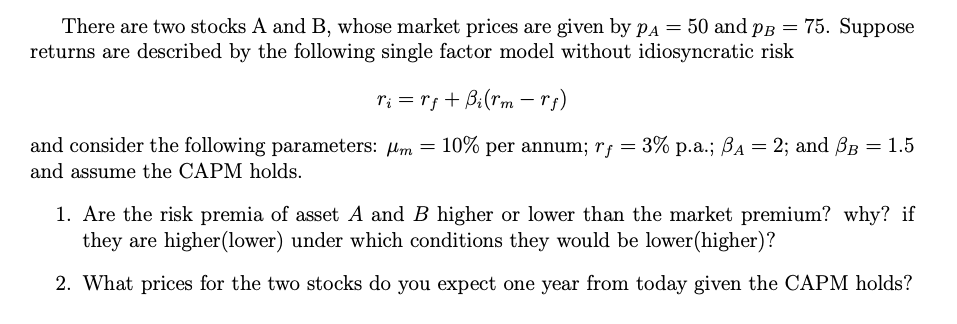

Question: There are two stocks A and B, whose market prices are given by Pa = 50 and PB = 75. Suppose returns are described by

There are two stocks A and B, whose market prices are given by Pa = 50 and PB = 75. Suppose returns are described by the following single factor model without idiosyncratic risk ri = rf + Bi(rm -rf) and consider the following parameters: flom = 10% per annum; rs = 3% p.a.; Ba= 3% p.a.; BA = 2; and BB = 1.5 and assume the CAPM holds. 1. Are the risk premia of asset A and B higher or lower than the market premium? why? if they are higher(lower) under which conditions they would be lower(higher)? 2. What prices for the two stocks do you expect one year from today given the CAPM holds? There are two stocks A and B, whose market prices are given by Pa = 50 and PB = 75. Suppose returns are described by the following single factor model without idiosyncratic risk ri = rf + Bi(rm -rf) and consider the following parameters: flom = 10% per annum; rs = 3% p.a.; Ba= 3% p.a.; BA = 2; and BB = 1.5 and assume the CAPM holds. 1. Are the risk premia of asset A and B higher or lower than the market premium? why? if they are higher(lower) under which conditions they would be lower(higher)? 2. What prices for the two stocks do you expect one year from today given the CAPM holds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts