Question: There can be more than 1 answer. You recently found out that when the market is in recession, ALL assets seem to suffer from some

There can be more than 1 answer.

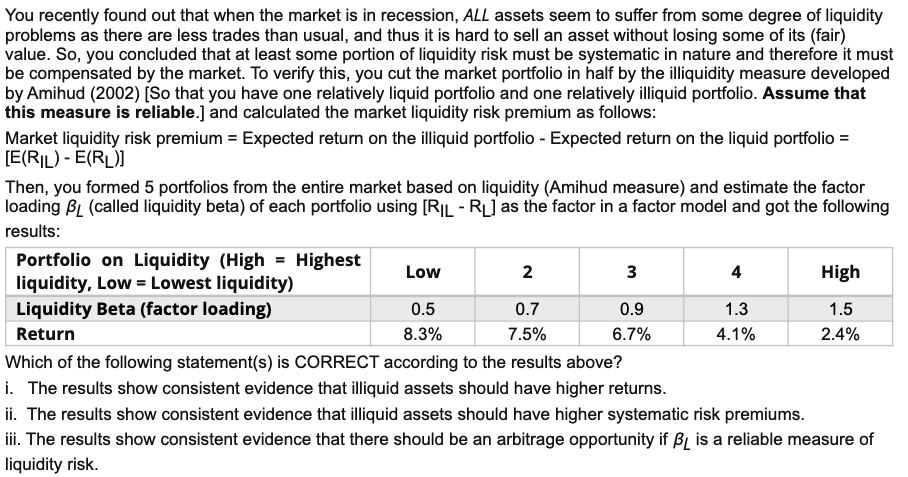

You recently found out that when the market is in recession, ALL assets seem to suffer from some degree of liquidity problems as there are less trades than usual, and thus it is hard to sell an asset without losing some of its (fair) value. So, you concluded that at least some portion of liquidity risk must be systematic in nature and therefore it must be compensated by the market. To verify this, you cut the market portfolio in half by the illiquidity measure developed by Amihud (2002) (So that you have one relatively liquid portfolio and one relatively illiquid portfolio. Assume that this measure is reliable.] and calculated the market liquidity risk premium as follows: Market liquidity risk premium = Expected return on the illiquid portfolio - Expected return on the liquid portfolio = [E(RIL) - E(RD)] Then, you formed 5 portfolios from the entire market based on liquidity (Amihud measure) and estimate the factor loading Bl (called liquidity beta) of each portfolio using [RIL-RJ as the factor in a factor model and got the following results: Portfolio on Liquidity (High = Highest Low 2 3 4 liquidity, Low = Lowest liquidity) High Liquidity Beta (factor loading) 0.5 0.7 0.9 1.3 1.5 Return 8.3% 7.5% 6.7% 4.1% 2.4% Which of the following statement(s) is CORRECT according to the results above? i. The results show consistent evidence that illiquid assets should have higher returns. ii. The results show consistent evidence that illiquid assets should have higher systematic risk premiums. iii. The results show consistent evidence that there should be an arbitrage opportunity if BL is a reliable measure of liquidity risk. You recently found out that when the market is in recession, ALL assets seem to suffer from some degree of liquidity problems as there are less trades than usual, and thus it is hard to sell an asset without losing some of its (fair) value. So, you concluded that at least some portion of liquidity risk must be systematic in nature and therefore it must be compensated by the market. To verify this, you cut the market portfolio in half by the illiquidity measure developed by Amihud (2002) (So that you have one relatively liquid portfolio and one relatively illiquid portfolio. Assume that this measure is reliable.] and calculated the market liquidity risk premium as follows: Market liquidity risk premium = Expected return on the illiquid portfolio - Expected return on the liquid portfolio = [E(RIL) - E(RD)] Then, you formed 5 portfolios from the entire market based on liquidity (Amihud measure) and estimate the factor loading Bl (called liquidity beta) of each portfolio using [RIL-RJ as the factor in a factor model and got the following results: Portfolio on Liquidity (High = Highest Low 2 3 4 liquidity, Low = Lowest liquidity) High Liquidity Beta (factor loading) 0.5 0.7 0.9 1.3 1.5 Return 8.3% 7.5% 6.7% 4.1% 2.4% Which of the following statement(s) is CORRECT according to the results above? i. The results show consistent evidence that illiquid assets should have higher returns. ii. The results show consistent evidence that illiquid assets should have higher systematic risk premiums. iii. The results show consistent evidence that there should be an arbitrage opportunity if BL is a reliable measure of liquidity risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts